Using ABLE Accounts to Protect Benefits While Paying a Family Caregiver

ABLE accounts are tax-advantaged savings accounts that let people with disabilities save and pay for qualified disability expenses without jeopardizing means-tested benefits. These accounts work by treating funds held in an ABLE account as disregarded assets for Medicaid and often as excluded resources for SSI up to certain limits, which makes them a practical tool for family caregivers who need to be paid for documented care. This guide explains how ABLE accounts function, who qualifies, which caregiver payments can count as qualified disability expenses (QDEs), and how to coordinate ABLE use with Medicaid, HCBS waivers, and consumer-directed programs. You will find step-by-step application checklists, state-specific considerations for Indiana, Michigan, and Illinois, comparison with Special Needs Trusts, and documentation templates to protect benefits while enabling caregiver pay. Throughout, the focus is educational and practical: what ABLE accounts do, how to document QDEs, and how to select the right combination of financial tools and support to keep benefits intact. Paid.care is noted here as a resource that helps family caregivers evaluate eligibility and navigate program enrollment; a brief mention appears at the end of this introduction with a simple call to action to check eligibility.

Paid.care supports family caregivers seeking payment while protecting benefits by offering eligibility guidance, free care coaching, and an app to help with care plans and hour tracking. The service also emphasizes higher pay rates for W2 caregivers, 24/7 support, and tools to coordinate payments with state programs in Indiana, Michigan, and Illinois.

What Is an ABLE Account and How Does It Protect Benefits for Family Caregivers?

An ABLE account (often called a 529A) is a tax-advantaged savings vehicle for individuals who became disabled before a statutory onset age; it lets the account owner save, invest, and withdraw funds tax-free for qualified disability expenses. The mechanism that protects benefits is the asset-disregard: funds in an ABLE account are typically not counted as resources for Medicaid eligibility and are excluded from SSI resource limits up to certain thresholds, which allows families to maintain public benefits while using saved funds to cover disability-related costs. Using ABLE funds correctly requires clear documentation that withdrawals pay for QDEs and coordination with case managers and benefits counselors to avoid unintended benefit impacts.

ABLE accounts centralize several protective features that matter for caregivers: tax-free growth on qualified withdrawals, owner control and authorized representative roles, and state-run program options that vary in fees and services. These features create flexibility for paying caregivers for documented personal care and related expenses while preserving means-tested benefits.

What Are the Key Features and Benefits of ABLE Accounts?

ABLE accounts deliver tax-advantaged growth and tax-free withdrawals when used for qualified disability expenses, making them an efficient vehicle for disability-related spending. Contributions may come from the beneficiary, family members, friends, or third parties, and many programs accept recurring electronic deposits, which supports steady funding for ongoing caregiver payments. Account owners retain control or can designate an authorized representative, allowing caregivers or family members to manage withdrawals and pay documented services while keeping funds segregated from other household assets. The combination of tax benefits, owner control, and broad QDE categories makes ABLE accounts particularly relevant for families balancing paid caregiving with means-tested benefit protection.

These features naturally lead into how ABLE accounts are treated by Medicaid and SSI, because legal treatment determines how much protection ABLE funds actually provide in practice.

How Do ABLE Accounts Safeguard Medicaid and SSI Eligibility?

ABLE accounts are treated as excluded resources under federal Medicaid rules for most state Medicaid programs, meaning balances ordinarily do not count toward the Medicaid asset limit that would otherwise disqualify a person. For SSI, federal rules exclude ABLE balances up to the SSI resource limit when managed correctly, but SSI beneficiaries may face monthly benefit adjustments if ABLE withdrawals are used to pay for food or shelter that would otherwise be provided by SSI—so careful categorization and documentation of QDEs is essential. State-level rules and estate recovery provisions can vary, so caregivers should confirm local Medicaid and SSI guidance and maintain detailed receipts, care plans, and timesheets showing that payments are for qualifying services. The next section explains who qualifies and the practical steps to open and manage an ABLE account so caregivers can implement these protections.

Who Qualifies for an ABLE Account and How Can Family Caregivers Apply?

ABLE eligibility centers on disability onset and documentation: an individual must have a qualifying disability that began before the statutory age threshold and must provide appropriate certification or SSA records. Most programs accept either a physician certification or a Social Security disability determination as proof, and many state ABLE programs publish specific enrollment documents and residency rules. Practical qualification also requires understanding whether the beneficiary currently receives SSI/SSDI or Medicaid, since existing benefit status influences reporting and coordination. The following H3 subsections give a concise eligibility checklist and a step-by-step opening and management walkthrough tailored to caregivers who will be paying for services.

Below is a short checklist to clarify common eligibility and documentation items before applying.

Gather medical certification or SSA disability determination as proof of onset.

Confirm the beneficiary’s state residency requirements for the chosen ABLE program.

Identify whether a guardian, authorized rep, or beneficiary will manage the account.

Prepare ID, Social Security number, and proof of address for account opening.

This checklist underscores preparatory steps so the caregiver can focus on a clean application and avoid delays in receiving payments.

What Are the Eligibility Requirements for ABLE Accounts?

Eligibility typically requires documentation that the beneficiary experienced the onset of the qualifying disability before the statutory age threshold; this is most commonly verified with a physician’s statement or SSA determination. Some state ABLE programs accept a wider set of medical records while others require formal SSA verification, so caregivers should compare enrollment paperwork for their state plan and choose the program that best matches residency and fee preferences. Residency can dictate program choice, but many programs accept out-of-state residents; account roles must also be established, naming the owner and, if appropriate, an authorized representative who can manage withdrawals and coordinate caregiver payments. Understanding these paperwork and role requirements up front reduces the risk of misclassification that could trigger a benefit review.

Clear verification of disability onset, matched with accurate identity and residency documentation, streamlines enrollment and supports future audits or benefit inquiries.

How Do You Open and Manage an ABLE Account for a Disabled Family Member?

Opening an ABLE account generally follows a straightforward online or paper application process: choose a state program, complete enrollment with owner and account manager details, submit disability proof, and fund the account through contributions from permitted sources.

Management practices that matter most for caregivers include setting up a separate designated account for caregiver payments, keeping meticulous records of withdrawals and receipts tied to QDEs, and assigning an authorized representative if the beneficiary cannot manage transactions independently. Best practices also recommend syncing ABLE withdrawal schedules with caregiver pay periods and using standardized timesheets, care plans, and invoices to document services rendered. Regular communication with the beneficiary’s Medicaid case manager or waiver coordinator helps ensure ABLE use aligns with program reporting requirements.

Good record-keeping not only protects benefits but also simplifies bookkeeping when caregivers are paid through consumer-directed programs or state-authorized payment systems.

What Expenses Are Qualified Disability Expenses for ABLE Accounts When Paying a Family Caregiver?

Qualified Disability Expenses (QDEs) are broadly defined to include education, housing, transportation, personal support services, and health care expenses that relate to the beneficiary’s disability, and many caregiver payments fit within these categories when properly documented. The defining principle is that the expense must be incurred to maintain or improve health, independence, or quality of life related to the disability; this allows caregiver compensation for ADL assistance, transportation to medical appointments, and therapy support when invoices and care plans substantiate the connection. However, gray areas—such as room and board or payments that substitute for SSI-provided benefits—require careful handling and explicit documentation to avoid unintended SSI adjustments. The subsections below list common caregiving QDE examples and practical structuring tips to pay family caregivers while preserving benefits.

Which Caregiving and Personal Care Costs Can ABLE Accounts Cover?

ABLE funds can cover a wide range of caregiving-related costs when the expense is directly tied to the beneficiary’s disability and supported by documentation: hands-on personal care, adaptive equipment, in-home therapy, and transportation to medical visits are common examples. Payments to family caregivers can qualify if the services provided are described in a care plan, documented with signed timesheets or invoices, and match the level of care required by the beneficiary’s condition. To strengthen the QDE position, caregivers should align compensation rates with local market rates, use W2 payroll when feasible for transparency, and maintain contemporaneous records that connect each payment to a documented need. These practices reduce audit risk and make it easier to demonstrate that ABLE withdrawals funded legitimate disability-related services.

How Can ABLE Accounts Be Used to Pay Family Caregivers Without Affecting Benefits?

To use ABLE funds for caregiver pay without affecting Medicaid or SSI, structure payments as documented QDEs, maintain a clear care plan, and preserve a paper trail that links hours worked to the beneficiary’s documented needs and scheduled services. Work with case managers to confirm that the caregiver’s role and compensation method fit waiver or consumer-directed program requirements, and prefer transparent payroll methods when possible to show proper withholding and reporting. Retain invoices, timesheets, and care plan updates for at least several years to support benefit reviews, and avoid using ABLE funds for general household expenses or room-and-board unless specifically approved and documented. These steps minimize the chance that an agency will reclassify ABLE withdrawals as countable income or a resource that affects benefits.

Routine coordination with benefit administrators and conservatively documented QDEs make ABLE-funded caregiver payments defensible and sustainable.

How Do ABLE Accounts Interact with Medicaid and Other Government Caregiver Payment Programs?

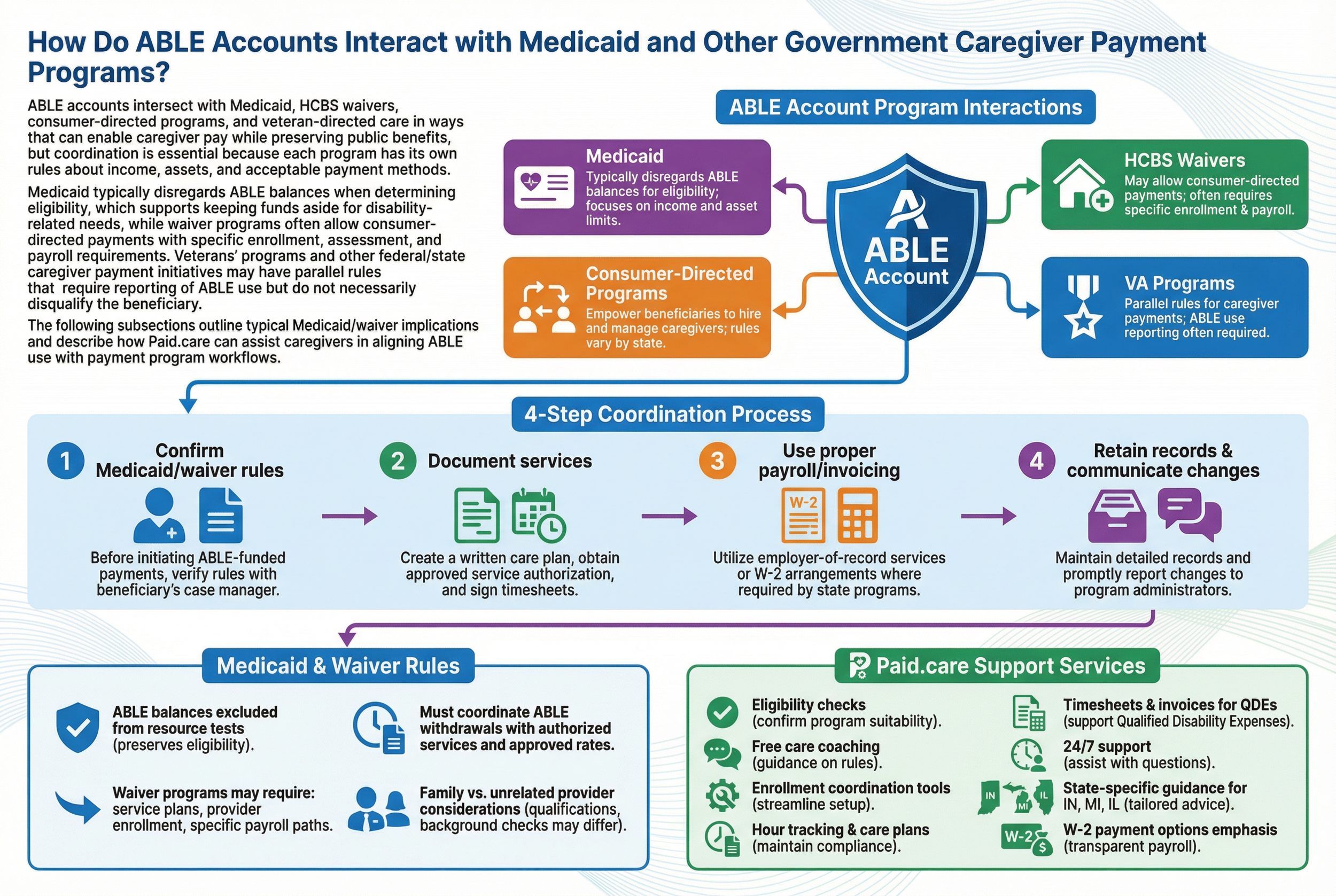

ABLE accounts intersect with Medicaid, HCBS waivers, consumer-directed programs, and veteran-directed care in ways that can enable caregiver pay while preserving public benefits, but coordination is essential because each program has its own rules about income, assets, and acceptable payment methods. Medicaid typically disregards ABLE balances when determining eligibility, which supports keeping funds aside for disability-related needs, while waiver programs often allow consumer-directed payments with specific enrollment, assessment, and payroll requirements. Veterans’ programs and other federal/state caregiver payment initiatives may have parallel rules that require reporting of ABLE use but do not necessarily disqualify the beneficiary. The following subsections outline typical Medicaid/waiver implications and describe how Paid.care can assist caregivers in aligning ABLE use with payment program workflows.

Below is a numbered list summarizing practical coordination steps caregivers should take when using ABLE accounts alongside government payment programs.

Confirm Medicaid/waiver rules with the beneficiary’s case manager before initiating ABLE-funded payments.

Document caregiver services with a written care plan, approved service authorization, and signed timesheets.

Use payroll or formal invoicing when state programs require employer-of-record or W2 arrangements.

Retain records and communicate changes to program administrators promptly to avoid retroactive benefit adjustments.

What Are Medicaid ABLE Account Rules and Waiver Program Implications?

Medicaid’s general approach excludes ABLE account balances from resource tests, which preserves eligibility even when savings exist, but waiver program operations may impose additional reporting and payment method requirements that affect how caregivers are paid. For consumer-directed programs, states often require service plans, provider enrollment, and specific payroll paths; ABLE withdrawals used to fund those payments must be traceable to approved services and match authorized rates. Some waivers may treat caregiver pay differently for relatives versus unrelated providers, so confirming whether family caregivers must meet provider qualifications or undergo background checks is essential. Coordinating ABLE withdrawals with authorized service authorizations and payroll avoids mismatches between program records and ABLE distributions that could prompt reviews.

How Does Paid.care Help Family Caregivers Use ABLE Accounts for Payment and Benefits Protection?

Paid.care provides practical navigation and support for family caregivers who want to be paid while protecting benefits, offering eligibility checks, free care coaching, and tools to coordinate enrollment and payment workflows with state programs. Their app helps track hours, build care plans, and produce the timesheets and invoices often needed to demonstrate QDEs, while coaching and 24/7 support assist families in aligning payments with Medicaid and waiver rules. Paid.care also connects caregivers to state-specific program guidance for Indiana, Michigan, and Illinois and emphasizes higher pay rates and W2 payment options for qualified caregivers, which supports transparent payroll documentation. For caregivers seeking hands-on coordination of payment setup and benefit protection, Paid.care is positioned as a resource to streamline the application, documentation, and ongoing reporting processes.

What Are the State-Specific ABLE Account Rules for Family Caregivers in Indiana, Michigan, and Illinois?

State ABLE programs vary on fees, enrollment options, and administrative details that affect caregivers, so understanding local differences in Indiana, Michigan, and Illinois helps families select the program that best aligns with their needs. Some states offer low-cost online enrollment, mobile management tools, and different contributor policies, while others provide enhanced customer support or broader residency acceptance. Medicaid waiver administration and consumer-directed payment rules also differ by state, influencing whether family caregivers can be paid easily through state systems and how ABLE funds should be documented for waiver-authorized services. The subsections below summarize practical state-level considerations and actions caregivers in each state can take.

A concise bulleted list shows immediate next steps for caregivers in these states.

Identify the specific state ABLE program and compare account fees and online features.

Confirm waiver and consumer-directed rules for paying family caregivers in your state.

Set up documentation templates (care plan, timesheet, invoice) aligned with state program expectations.

Seek local coaching or support from organizations familiar with state waiver operations.

How Do Indiana ABLE Account Regulations Affect Caregiver Pay and Benefits?

In Indiana, caregivers should examine the state program’s enrollment process, fee schedule, and whether out-of-state residents are accepted, because those factors influence where to open an ABLE account and how quickly funds are available for caregiver payments. Indiana’s Medicaid waiver operations and consumer-directed payment systems will dictate required documentation and provider enrollment steps for family caregivers, so establishing a care plan and timesheet format that matches state expectations simplifies approval. Caregivers in Indiana should also coordinate with the beneficiary’s case manager to ensure that ABLE withdrawals are recognized as QDEs within the waiver or Medicaid plan and to avoid any reporting gaps. Taking these steps proactively reduces administrative delays and supports consistent caregiver compensation.

What Should Caregivers Know About Michigan and Illinois ABLE Programs?

For Michigan and Illinois, caregivers must review each state’s ABLE program features—such as online account management tools, minimum contribution rules, and fee structures—and confirm how state Medicaid waivers treat caregiver payments and documentation. Michigan’s and Illinois’s waiver programs may have different registration requirements for family providers, different payroll pathways, and varying case manager expectations for documentation, so caregivers should adapt timesheet and care plan templates accordingly. In both states, using standardized records and aligning pay rates with program-authorized amounts helps ensure ABLE-funded payments are recognized as QDEs and do not jeopardize benefits. Connecting with local resources or coaching can speed enrollment and clarify state-specific enrollment nuances.

These state-level considerations feed naturally into choosing between ABLE accounts and other tools like Special Needs Trusts when families face larger financial or estate-planning needs.

How Do ABLE Accounts Compare to Special Needs Trusts and Other Financial Tools for Caregivers?

ABLE accounts and Special Needs Trusts (SNTs) share the goal of protecting eligibility for means-tested benefits, but they differ in capacity, flexibility, cost, and legal complexity. ABLE accounts are generally lower-cost, easier to set up, and optimal for managing modest savings and recurring caregiving expenses, whereas SNTs can hold larger assets, provide more exhaustive estate-planning solutions, and offer protections beyond contribution caps but require legal setup and trustee management. For caregivers who need to pay family members for documented daily services and who will use modest sums, ABLE accounts are often preferable; families with significant assets, complex estate goals, or beneficiaries who exceed ABLE contribution limits may need an SNT or a hybrid approach.

What Are the Advantages and Limitations of ABLE Accounts vs. Special Needs Trusts?

ABLE accounts offer clear advantages for many caregivers: straightforward online setup, tax-free qualified withdrawals, owner control or authorized representative access, and suitability for funding caregiver payments when amounts are moderate. Limitations include statutory onset and age rules, contribution caps that cap long-term savings, and potential SSI monthly payment adjustments if funds cover food or shelter in ways that substitute SSI. Special Needs Trusts address many of those limitations by accommodating larger sums and offering richer estate-planning features, but they require legal formation, ongoing trustee management, and sometimes higher operational cost. Caregivers should weigh immediate caregiving funding needs against long-term financial complexity when selecting the right instrument.

When Should Family Caregivers Consider Alternatives to ABLE Accounts?

Families should consider alternatives to ABLE accounts if the beneficiary needs access to funds beyond ABLE contribution limits, if the disability onset rules exclude the beneficiary, or if estate-planning goals require trustee discretion and creditor protection that an ABLE account cannot provide. Indicators for alternatives include large inheritances or settlements, complex family financial situations, or plans that involve significant housing or long-term care funding where SNTs or other legal structures are more appropriate. The recommended next steps are to consult a special-needs attorney or financial planner, compare projected cash-flow needs against ABLE limits, and, if helpful, use services that combine program navigation with documentation support to implement the chosen tool. Paid.care can be a starting resource to clarify eligibility and payment workflows before engaging legal counsel.

When caregivers combine professional legal advice with practical enrollment and documentation support, they create a defensible, benefit-preserving payment structure that suits both present care and future planning.

FAQs

-

An ABLE (Achieving a Better Life Experience) account is a tax-advantaged savings account for eligible individuals with disabilities. Money in an ABLE account can be used for qualified disability expenses (QDEs) without jeopardizing SSI, Medicaid, and other means-tested benefits, up to certain limits. When structured correctly, families can use ABLE funds to pay a family caregiver for services like personal care, transportation, or support with daily living—while helping the disabled person stay under asset limits.

-

Generally, no—if the payment is for a qualified disability expense and is made directly from the ABLE account. The ABLE account balance (up to allowed caps) is usually not counted as a resource for SSI/Medicaid, and using it for disability-related care is exactly what the account is designed for. Problems can arise if:

Money is withdrawn and then parked in the caregiver’s or beneficiary’s regular account without being used for QDEs

Payments look like gifts rather than payments for documented services

Spending violates other program rules (for example, how “in-kind support and maintenance” is treated for SSI)

Good records and clear documentation of the caregiver’s work are essential.

-

Qualified disability expenses are broadly defined to benefit the person with a disability, and often include:

Personal care assistance and home care

Health and wellness services, including help with ADLs

Transportation related to medical or disability needs

Assistive technology, supervision, or behavior support

Services needed to live as independently as possible

If a family caregiver is helping with tasks tied to the disability—bathing, dressing, medication reminders, meal prep, transportation to appointments—paying them from the ABLE account can usually be justified as a QDE. Keep written descriptions of duties, timesheets, and payment records to show how the expense benefits the beneficiary.

-

To show that payments are wages for real services (not disguised gifts):

Create a simple written caregiver agreement describing duties, rate of pay, and schedule

Make sure the rate is reasonable for your area (similar to what an agency might charge for similar care)

Pay the caregiver in a consistent way—check, direct deposit, or documented transfer—from the ABLE account

Keep timesheets or logs of hours worked and tasks performed

Save invoices or notes showing that payments came from the ABLE account and were tied to that written agreement

This kind of paper trail helps if SSI, Medicaid, or a tax authority ever reviews how the ABLE funds were used.

-

Because ABLE rules interact with tax law, SSI, Medicaid, and sometimes state-specific programs, it’s wise to get advice before you start:

A benefits planner, social worker, or disability advocate who understands SSI/Medicaid

A tax professional (CPA or enrolled agent) familiar with ABLE accounts and caregiver pay

In more complex situations, an elder law or special needs planning attorney

They can help you confirm that the caregiver arrangement, pay structure, and ABLE spending all line up—so you can support your loved one, pay family caregivers fairly, and protect crucial benefits at the same time.