The Sandwich Generation Financial Survival Guide: How to Get Paid and Manage Dual Caregiving Costs

The Sandwich Generation refers to adults who are simultaneously caring for their aging parents while supporting their own children. This unique position often leads to significant financial strain as they juggle the costs of childcare and eldercare. In this comprehensive guide, we will explore the financial challenges faced by the Sandwich Generation and provide actionable strategies to manage these costs effectively. You will learn how to navigate caregiver payment programs, financial planning strategies, and long-term care considerations. Additionally, we will highlight how services like Paid.care can assist in alleviating some of the financial burdens associated with caregiving. By understanding these aspects, you can better prepare for the financial realities of being part of the Sandwich Generation.

Research further emphasizes the growing prevalence and multifaceted challenges faced by this demographic.

What Financial Challenges Does the Sandwich Generation Face?

The Sandwich Generation faces a myriad of financial challenges as they balance the needs of both children and elderly parents. These challenges can lead to significant stress and financial instability.

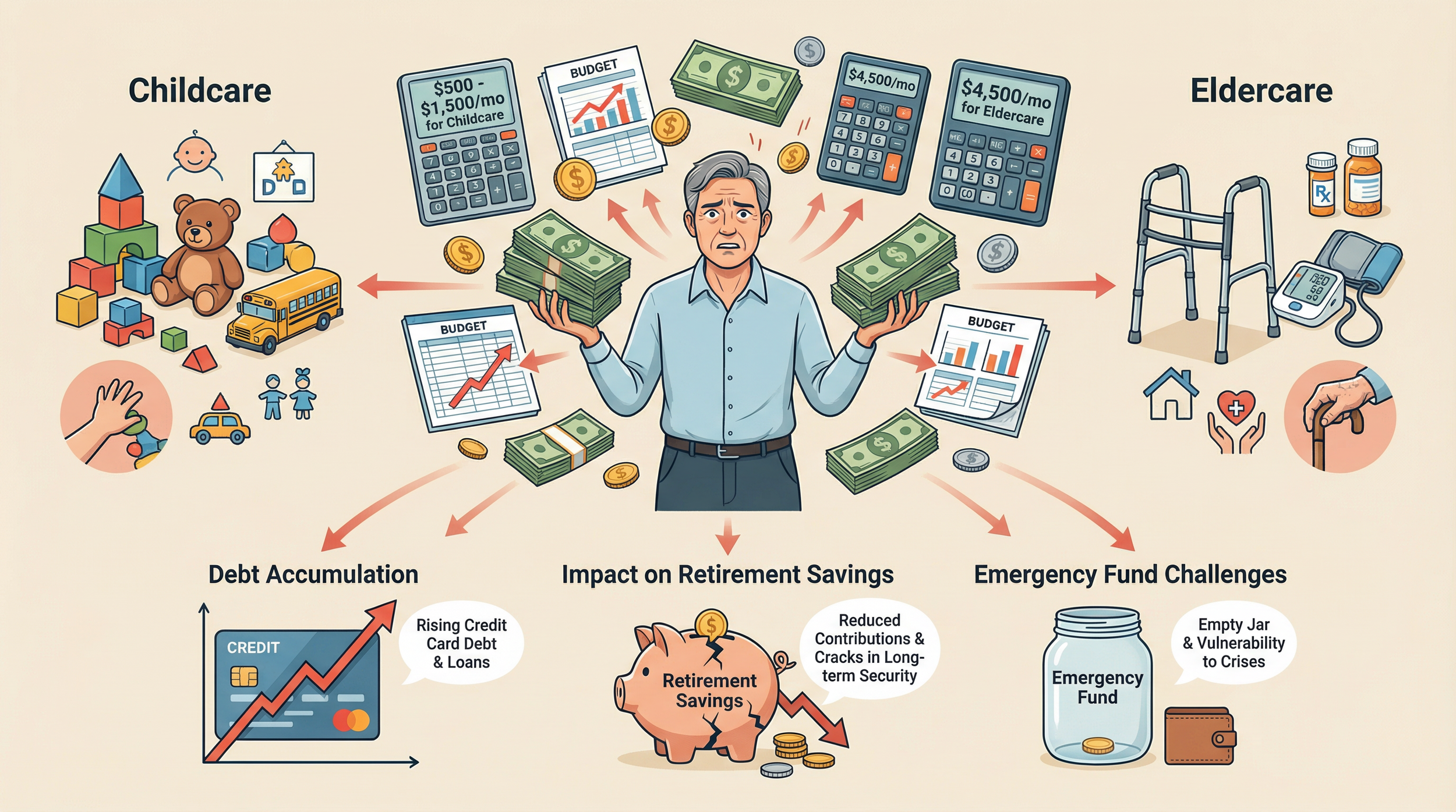

How Do Childcare and Eldercare Costs Impact Your Budget?

Childcare and eldercare costs can severely impact your budget, often leading to difficult financial decisions. The average cost of childcare can range from about $500 to $1,500 per month, depending on the age of the child and the type of care required. Similarly, eldercare costs can vary widely, with in-home care averaging around $4,500 per month nationally. These expenses can quickly add up, straining the finances of caregivers who are already managing their own household costs.

What Are Common Financial Strains for Dual Caregivers?

Debt Accumulation: Many caregivers find themselves taking on debt to cover unexpected expenses related to caregiving.

Impact on Retirement Savings: The financial demands of caregiving can lead to reduced contributions to retirement accounts, jeopardizing long-term financial security.

Emergency Fund Challenges: Caregivers may struggle to maintain an emergency fund, leaving them vulnerable to financial crises.

Understanding these strains is crucial for developing effective financial strategies.

How Can You Get Paid to Care for Elderly Parents?

Getting paid for caregiving can significantly alleviate financial pressure for the Sandwich Generation. Various programs exist to support family caregivers financially.

What Medicaid and Government Programs Support Caregiver Payment?

Several Medicaid and government programs can help caregivers receive payment for their services.

How Does Paid.care Simplify Getting Paid for Family Caregiving?

Paid.care is a service designed to help family caregivers navigate the complexities of getting paid for their caregiving efforts. They offer free coaching and support to help caregivers understand eligibility requirements and application processes for various programs. Additionally, Paid.care provides a user-friendly app that allows caregivers to track hours and receive payments weekly, simplifying the financial aspect of caregiving.

What Financial Planning Strategies Help Balance Childcare and Eldercare?

Effective financial planning is essential for balancing the costs associated with childcare and eldercare.

How Can Budgeting and Expense Management Ease Dual Caregiving Costs?

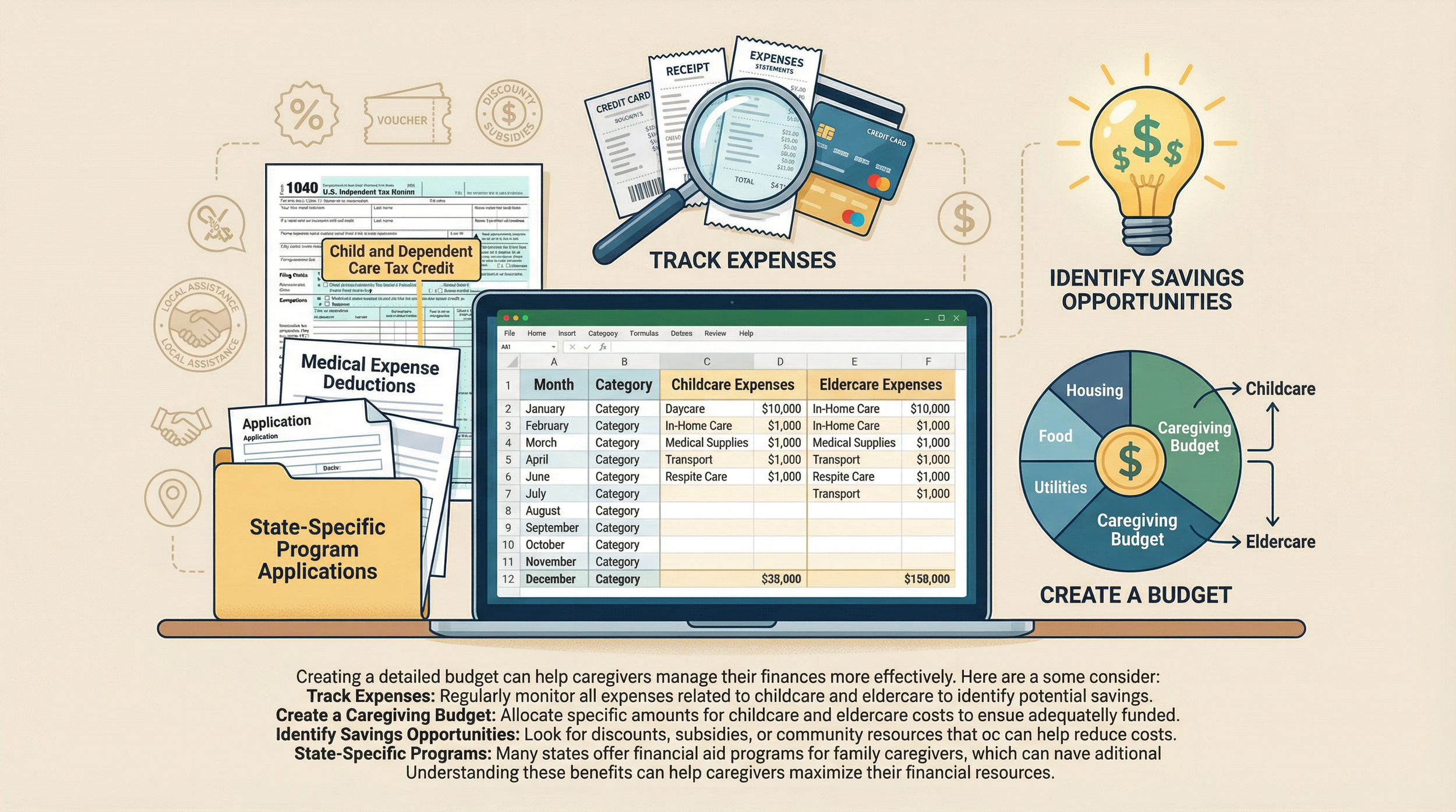

Creating a detailed budget can help caregivers manage their finances more effectively. Here are some strategies to consider:

Track Expenses: Regularly monitor all expenses related to childcare and eldercare to identify areas for potential savings.

Create a Caregiving Budget: Allocate specific amounts for childcare and eldercare costs to ensure that both areas are adequately funded.

Identify Savings Opportunities: Look for discounts, subsidies, or community resources that can help reduce costs.

Implementing these strategies can lead to better financial management and reduced stress.

What Tax Benefits and Financial Aid Are Available for Family Caregivers?

Family caregivers may be eligible for various tax benefits and financial aid options, including:

Child and Dependent Care Tax Credit: This credit can help offset childcare costs for working parents.

Medical Expense Deductions: Caregivers can deduct certain medical expenses related to the care of their elderly parents if they itemize deductions and meet IRS criteria.

State-Specific Programs: Many states offer financial aid programs for family caregivers, which can provide additional support.

Understanding these benefits can help caregivers maximize their financial resources.

How Should You Plan for Long-Term Care and Estate Considerations?

Planning for long-term care and estate considerations is vital for the Sandwich Generation.

What Are Key Long-Term Care Insurance and Medicaid Planning Tips?

When considering long-term care insurance and Medicaid planning, keep these tips in mind:

Assess Your Needs: Evaluate the potential need for long-term care based on family history and personal health.

Research Insurance Options: Look for policies that offer comprehensive coverage for in-home care and assisted living.

Understand Medicaid Eligibility: Familiarize yourself with the eligibility requirements for Medicaid, which vary by state, to ensure you can access benefits when needed.

These steps can help secure financial stability for both caregivers and their loved ones.

How Can Estate Planning Protect Your Family’s Financial Future?

Estate planning is crucial for protecting your family's financial future. Key components include:

Creating a Will: A will ensures that your assets are distributed according to your wishes.

Establishing Power of Attorney: Designating a trusted individual to make financial and medical decisions on your behalf can provide peace of mind.

Setting Up Trusts: Trusts can help manage assets and provide for family members while minimizing tax implications.

By addressing these estate planning elements, caregivers can safeguard their family's financial well-being.

What Real-Life Stories Show Financial Relief Through Paid.care?

Real-life testimonials can illustrate the impact of services like Paid.care on family caregivers.

How Have Family Caregivers Benefited Financially Using Paid.care?

Many family caregivers have reported significant financial relief after utilizing Paid.care's services. For instance, caregivers have shared stories of how they were able to receive timely payments for their caregiving efforts, allowing them to focus more on their loved ones rather than financial stress.

What Testimonials Highlight Improved Quality of Life for Sandwich Generation Caregivers?

Testimonials from caregivers highlight the emotional and practical benefits of using Paid.care. Many have expressed gratitude for the support and resources provided, which have improved their overall quality of life. Caregivers often report feeling more empowered and less overwhelmed, knowing they have a reliable system in place to manage their caregiving responsibilities.

FAQs

-

It can, if you aren't careful. Medicaid has a 5-year "look-back" period. If your parent pays you cash without a formal agreement, Medicaid may classify those payments as "gifts" rather than compensation for services. This can disqualify them from coverage.

The Fix: You must have a notarized Personal Care Agreement (or Family Care Contract) in place before payments begin. This document proves the money is a legitimate expense for care services, not a gift to a child.

-

Only if they qualify as your "tax dependent." Generally, the IRS allows you to use HSA/FSA funds for a relative only if you provide more than 50% of their financial support for the year.

Tip: If you meet this threshold, you can use these pre-tax dollars for their hearing aids, walkers, copays, and even home modifications (like wheelchair ramps).

-

It usually doesn't help automatically, but you can ask for an adjustment. Standard FAFSA forms look at your income and assets. Spending money on parents doesn't automatically lower your "Student Aid Index" (SAI).

The Strategy: File a "Professional Judgment" appeal with the university's financial aid office. Document your out-of-pocket costs for elder care. Aid officers have the discretion to treat these expenses as a reduction in your available income, potentially increasing your child's aid package.

-

No. This is the most dangerous financial move you can make.

The Reality: Your children can borrow money for college (loans). Your parents may have safety nets (Medicaid/Social Security). You cannot borrow money for your retirement.

The Compromise: If you must reduce contributions, try to match only what your employer matches. Do not stop completely; you lose the compound growth and the "free money" match.

-

Transparency is key to preventing resentment. If you are doing the physical caregiving, it is reasonable for siblings to contribute financially to "offset" your lost wages or time.

The Caregiver Contract: Propose a family meeting where the parent pays the caregiving sibling a market rate (using the Personal Care Agreement mentioned in question #1). This ensures the inheritance isn't being "drained" unfairly—it is being used for legitimate care—and compensates the sibling doing the heavy lifting.