Self-Directed Care Fraud Risks: How Families Stay Compliant with Medicaid and Caregiver Regulations

Self-directed care lets people who qualify for Medicaid-funded long-term services and supports (LTSS) choose who provides their care, when services occur, and in many programs, pay family members for hands-on care. This guide explains what self-directed care is, why Medicaid compliance matters, and how family caregivers can reduce fraud, waste, and abuse while protecting payments and program eligibility. Readers will learn practical employer-like responsibilities, typical fraud scenarios that affect family caregiving, and step-by-step prevention and reporting workflows that preserve benefits and safety. The article also compares oversight tools such as Fiscal Management Services (FMS) and Electronic Visit Verification (EVV), shows how these tools work together, and provides clear, empathetic guidance on documenting, detecting, and reporting suspected misuse. Finally, the guide describes how Paid.care supports families through eligibility help, coaching, an app for tracking hours, and weekly payments, and it closes with anonymized success stories and practical lessons families can apply immediately.

What Is Self-Directed Care and What Are the Key Compliance Requirements for Family Caregivers?

Self-directed care (also called consumer-directed or participant-directed services) is a Medicaid program model that gives the care recipient control over hiring, scheduling, and paying caregivers within an approved budget and individual support plan (ISP). The model works by authorizing a budget under a Medicaid waiver or veteran-directed care plan, documenting services in an ISP, and using oversight mechanisms like timesheets, EVV logs, and FMS records to confirm services match billed hours. For families, the specific benefits are meaningful: continuity of care, flexibility to hire trusted relatives, and potential to receive payment for caregiving when state rules permit. Ensuring Medicaid compliance protects program eligibility and prevents repayment demands or legal consequences that can follow undocumented or ineligible payments. The next section explains how the operational flow — assessment, ISP, authorization, hiring, and oversight — functions in practice to maintain program integrity.

Paid.care can help families determine whether they meet eligibility for state-funded programs, explain state-specific rules, and guide caregivers through the documentation and employer-like responsibilities required to stay compliant. Paid.care’s role is high-level and practical: it assists with qualification for HCBS waivers and consumer-directed programs, clarifies program limits, and prepares families for required records and reporting. This bridge helps families understand eligibility before they move into program setup and oversight, and the dedicated business section later in this article describes Paid.care's services in more detail.

How Does Self-Directed Care Work and What Benefits Does It Offer Families?

Self-directed care begins with an assessment that identifies service needs and creates an Individual Support Plan (ISP) that defines allowable services, authorized hours, and budget limits. An approved ISP and budget authorization permit the care recipient or their representative to hire caregivers—often including family members—within program rules, and responsibility for oversight typically falls to the participant or representative. The model delivers concrete benefits: caregivers can provide consistent, personalized care; families maintain control over scheduling and tasks; and eligible family caregivers may receive payment for services that match the ISP. Oversight is built in through required documentation such as timesheets, budget reconciliations, and, increasingly, EVV records that verify time and location of care.

What Are the State-Specific Compliance Rules and Employer Responsibilities for Family Caregivers?

State rules vary, but common employer-like responsibilities include accurate timesheet management, verifying hours, complying with background check requirements where applicable, and understanding payroll and tax-related rules that FMS often helps administer. Families should confirm specific provisions in Indiana, Michigan, and Illinois—such as which family members are eligible to be paid, any documentation requirements, and EVV mandates—by consulting their state Medicaid agency’s guidance. Practical recordkeeping advice applies universally: retain copies of ISPs, authorization letters, budgets, timesheets, and any EVV logs for the program’s required retention period. Understanding and meeting these responsibilities prevents inadvertent noncompliance and helps preserve both payment streams and access to services.

What Are Common Fraud Risks in Self-Directed Care and How Can Families Prevent Them?

Self-directed care programs face distinct fraud, waste, and abuse risks because payments flow to individuals or small provider networks that may lack formal agency controls. Fraud occurs when services are billed but not delivered, waste when funds are used for unnecessary or inefficient services, and abuse when program rules are knowingly violated to obtain improper payments. Families can reduce these risks through regular verification of timesheets and EVV logs, prudent financial safeguards, caregiver vetting, and use of oversight tools such as FMS and EVV. The next subsection outlines typical family-focused scenarios, then we present prevention best practices that can be implemented immediately.

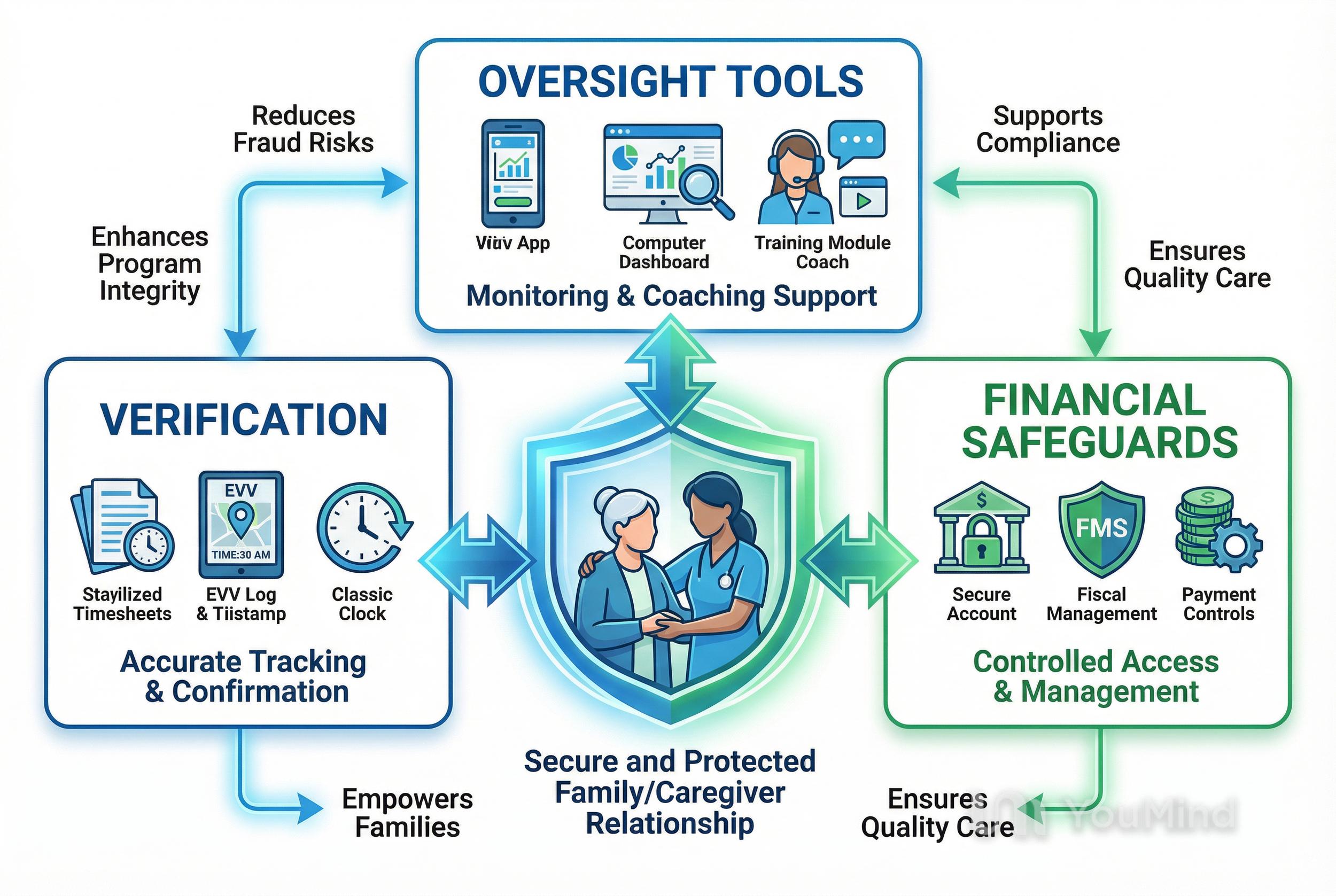

Many prevention tools are available to families; a few examples include Electronic Visit Verification to validate time and place of service, Fiscal Management Services to centralize payroll and flag anomalies, and consumer-facing mobile apps and coaching that help families track hours and maintain documentation. Paid.care’s mobile app and care coaching are examples of supportive tools that assist with timesheet tracking and clarify state rules, serving as one part of an overall prevention strategy.

What Are Typical Fraud, Waste, and Abuse Scenarios in Family Caregiving?

Family caregiving introduces unique scenarios where personal relationships and informal arrangements can create risk. One common pattern is timesheet inflation when hours are rounded up or recorded without direct verification, especially during complex household schedules. Another frequent issue is billing for care during hospital stays or vacations; without cross-checks, payments may continue erroneously. Financial exploitation can occur if a paid caregiver or family member gains uncontrolled access to bank accounts or benefit payments. Finally, using unapproved tasks or unqualified workers to perform skilled services can result in improper billing and jeopardize program compliance.

Each scenario harms both the care recipient—through misallocated funds or reduced service—and the payer program, which may seek repayment or remove benefits. Recognizing these family-specific patterns helps target prevention steps like secure financial controls and careful reconciliation of service records. The following subsection provides an actionable checklist households can adopt immediately.

How Can Families Use Best Practices to Avoid Caregiver Fraud and Financial Exploitation?

Implementing consistent routines and safeguards prevents most common issues. First, set a weekly verification habit: review and sign timesheets, compare EVV logs, and reconcile with the ISP’s authorized hours. Second, limit financial access by using safeguards such as restricted accounts, pre-authorized payments, or FMS-held funds where available to prevent direct control over benefit checks. Third, establish hiring protocols—check qualifications, document training, and require written task lists—to avoid unauthorized services. Fourth, maintain a single source of truth for documentation (a dedicated app, binder, or FMS reports) and keep dated copies of every timesheet, invoice, and ISP change.

Families should also adopt three simple communication rules:

Hold a brief weekly caregiving check-in to confirm hours and tasks.

Keep a log of service-related calls or messages tied to dates.

Escalate discrepancies promptly to the FMS or program coach for reconciliation.

Following these routines makes inconsistencies visible early and creates a clear audit trail that supports Medicaid compliance.

How Do Fiscal Management Services and Electronic Visit Verification Support Fraud Prevention and Compliance?

Fiscal Management Services (FMS) and Electronic Visit Verification (EVV) are complementary oversight tools designed to protect program integrity and simplify caregiver compliance. FMS acts as a fiscal intermediary, handling payments, payroll taxes, and budget reconciliation so caregivers receive approved wages while the program monitors spending against the authorized budget. EVV captures time and place for service delivery through methods like mobile apps, telephony, or GPS-enabled devices, ensuring billed hours match actual visits. Together, FMS and EVV create multiple verification layers: FMS reconciles payments and flags anomalies while EVV provides timestamped evidence that services occurred at specified times and locations. The following subsections examine each tool’s role and how families should interact with them.

Intro paragraph for table context: the table below summarizes the primary functions and practical benefits of FMS, EVV, and manual oversight for family caregivers choosing a mix of tools.

What Role Does Fiscal Management Services Play in Budget Oversight and Fraud Prevention?

FMS providers process caregiver payroll, withhold and remit required taxes, and produce reconciliation reports that compare paid hours against authorized budgets, making them a central control point for fraud prevention. FMS systems commonly flag unusual activity—such as sudden spikes in hours or payments outside normal ranges—so program administrators or family representatives can investigate early. For families, FMS reduces the risk of handling cash payments directly and provides a documented payment history useful for audits and disputes. To get the most value, caregivers and family employers should review FMS statements each pay period, reconcile against timesheets and EVV logs, and alert the FMS or program coach if discrepancies appear.

How Does Electronic Visit Verification Ensure Timesheet Accuracy and Program Integrity?

EVV systems record the start and end times and typically the location of in-home services using mobile apps, GPS, telephony, or other device-based check-ins, which reduces opportunities to claim unrendered hours. EVV data serves as objective evidence that can be reconciled with caregiver timesheets and FMS payment records, and it streamlines audits by providing timestamped logs. Families should know the EVV method their program uses, confirm that caregiver check-ins correspond to scheduled hours, and document any mismatches immediately so that corrections occur before payments are finalized. Privacy and accessibility considerations matter too; families should work with program staff to address concerns about device access or data visibility while preserving EVV’s fraud-prevention advantages.

How Can Families Detect, Report, and Respond to Self-Directed Care Fraud?

Detecting fraud begins with awareness of concrete warning signs, then preserving documentation and following a clear reporting workflow to state agencies or program oversight bodies. Early detection often relies on routine reconciliation between timesheets, EVV logs, FMS reports, and bank or benefit statements; when these records diverge, families should gather evidence and follow reporting steps promptly. This section lists the most common signs to watch for and then provides a step-by-step reporting procedure that families can use when they suspect fraud. Maintaining an empathic but proactive stance protects both the care recipient and the family’s access to services.

Below is a prioritized list of warning signs families should monitor regularly and the immediate action each sign suggests.

Sudden, unexplained changes in bank account activity or missing funds: review statements and restrict financial access.

Caregiver reluctance to allow review of timesheets, schedules, or EVV logs: document refusals and escalate to the FMS or program coordinator.

Inconsistent caregiver statements about hours or services compared to EVV/timesheets: reconcile logs and request written clarifications.

Services billed during documented hospitalizations or absences: compare medical records with billed dates and report discrepancies.

Frequent last-minute changes to ISPs or hours without supporting documentation: request program authorization and retain copies.

What Are the Warning Signs of Caregiver Fraud and Financial Exploitation?

Financial exploitation and caregiver fraud often present as behavioral and financial red flags that families can spot if they maintain active oversight. Watch for unexplained withdrawals, new payees on accounts, abrupt changes in the care recipient’s will or beneficiary designations, or sudden cutoffs of contact between the recipient and family members. Other signs include caregivers refusing oversight, frequent missing receipts, or repeated billing for services that the recipient or other family members cannot verify. Behavioral markers—such as a caregiver isolating the recipient or discouraging family involvement—may accompany financial warning signs and warrant immediate attention. Early recognition of these indicators allows families to create an audit trail and take protective steps before harm escalates.

How Do Families Report Suspected Fraud and Protect Their Loved Ones?

When fraud is suspected, families should follow a clear, documented sequence: collect and secure all relevant records (timesheets, EVV logs, FMS statements, bank statements, and communications), notify the FMS provider and program case manager to request an internal reconciliation, and then report unresolved issues to the state Medicaid fraud unit or the Office of Inspector General (OIG). If the care recipient is at risk of harm, contact Adult Protective Services promptly and arrange alternate caregiving while investigations proceed. Use these steps as a checklist:

Preserve evidence: scan or copy all documents and logs.

Notify program intermediaries: contact FMS and the case manager for immediate review.

File formal reports: submit findings to state Medicaid fraud units or OIG if discrepancies remain.

Protect finances and care: restrict account access, set up temporary payment holds via FMS, and secure alternate care if safety concerns exist.

How Does Paid.care Help Families Stay Compliant and Prevent Fraud in Self-Directed Care?

Paid.care supports family caregivers by facilitating payment for in-home care services and guiding caregivers through qualification for state-funded programs, with operations in states including Indiana, Michigan, and Illinois. Core services include assistance with qualification for Medicaid and government programs (HCBS waivers, consumer-directed programs, and veteran-directed care), dedicated care coaching, weekly payment processing, high pay rates, free care coaching, 24/7 support, and a mobile application for managing care tasks and tracking hours. Paid.care’s approach centers on simplifying the qualification process, clarifying state-specific rules, and reducing administrative friction so families can focus on safe, compliant caregiving. The company’s services bridge the gap between program requirements and daily caregiving routines by combining tech-enabled documentation with human coaching.

How Does Paid.care’s Coaching and Mobile App Support Compliance and Fraud Prevention?

Paid.care’s free care coaching helps families understand the nuances of state-specific program rules and set up compliant workflows for hiring, timesheet collection, and record retention. Coaches explain employer-like responsibilities and provide procedural guidance for reconciling timesheets with FMS statements and EVV logs, reducing errors that could trigger audits. The mobile app supports documentation by tracking hours and tasks, storing timesheets, and making it easier to produce a chronological record if discrepancies arise. Combined with 24/7 support, coaching and app-based tracking help families adopt routine verification habits that make fraud detection and prevention practical and sustainable.

What Is the Eligibility and Application Process for Paid.care’s Family Caregiver Payment Services?

Paid.care guides families through a stepwise eligibility and onboarding process that begins with a state-specific assessment to determine program fit and qualification for Medicaid waivers or consumer-directed services. Typical steps include collecting necessary documentation, confirming the care recipient’s ISP and authorized hours, completing program enrollment forms, and setting up app access and payment preferences during onboarding. After approval, families receive coaching on compliant recordkeeping and begin weekly payment processing, which helps maintain stable income flows while ensuring documentation aligns with program rules. Expected timelines and exact document lists are program-dependent, but Paid.care emphasizes clear guidance during each phase to minimize confusion and support caregiver compliance.

What Are Real-Life Success Stories of Families Achieving Compliance and Fraud Prevention with Paid.care?

Anonymized examples from families working with Paid.care demonstrate how coaching and app-driven documentation resolve common compliance gaps and prevent costly mistakes. In one case, a family discovered discrepancies between manually kept logs and FMS statements during onboarding; Paid.care coaching helped them implement weekly reconciliations and correct historical timesheet errors before an audit. In a second example, a caregiver’s unfamiliarity with state-specific allowable tasks led to improper reporting; timely coaching clarified the ISP boundaries and prevented an improper claim. In another situation, app-based hour tracking helped prove that services were delivered as scheduled after a third party questioned billed hours, protecting ongoing payments.

How Have Families Benefited from Paid.care’s Support in Managing Self-Directed Care Compliance?

Families report several concrete benefits from combining coaching with technology and structured payment processes. First, onboarding with a coach corrected documentation issues that would otherwise have required repayment; early corrections preserved eligibility and prevented retroactive denials. Second, weekly payments stabilized household finances and reduced the temptation to shortcut documentation processes. Third, having a centralized app for timesheets and task logs simplified reconciliations with FMS statements and provided evidence in disputes. These benefits translated into greater confidence for family employers and clearer audit trails for programs.

What Lessons Can Families Learn from These Compliance Success Stories?

The core lessons are practical and repeatable: establish a single source of truth for service records, reconcile timesheets and FMS statements weekly, and use coaching or program support to clarify ambiguous rules before they become problems. Families should adopt simple routines—daily or weekly tracking, immediate documentation of absences, and prompt escalation of discrepancies—to avoid compounding errors. Leveraging supportive technologies and third-party payment processing reduces both administrative burden and opportunities for fraud. Finally, seeking eligibility assistance early prevents missteps during the application and onboarding process.

Create a single documentation system: consolidate timesheets, EVV logs, and ISP notes in one place.

Reconcile weekly: compare caregiver logs to FMS reports and EVV records each pay period.

Use coaching: ask questions early when a rule is unclear to prevent errors.

Limit financial access: keep benefit payments within managed channels to avoid exploitation.

Document everything: dated records shorten resolution times during audits.

These steps helped the anonymized families above avoid repayment demands, maintain program access, and reduce stress—actions any household can begin implementing this week. To check whether your household qualifies for paid family caregiving and to get personalized guidance, check your eligibility with Paid.care today.

FAQs

-

Self-directed care fraud happens when someone intentionally misuses Medicaid funds or violates program rules in a self-directed (consumer-directed) caregiver program. Common examples include billing for hours not actually worked, having a “ghost caregiver” who never provides services, falsifying timesheets, paying caregivers who are not approved, or using Medicaid funds for non-care-related expenses. Even if a family “bends the rules” to help out, Medicaid can still treat it as fraud.

-

Yes. Medicaid agencies and fiscal intermediaries look at the documentation and behavior, not just intent. If timesheets are inaccurate, services don’t match the approved care plan, or money is used in ways not allowed by the program, the state may require repayment and can impose penalties. In serious cases, families or caregivers can face program termination or even criminal investigation, even if they thought they were just making a harmless adjustment. That’s why careful recordkeeping is critical.

-

Some common red flags include:

Timesheets that show more hours than are authorized in the care plan

Caregivers claiming to work while also clocked in at another job

Signatures that appear forged or repeated exactly on every timesheet

Payments to caregivers who don’t live in the area or never appear at appointments

Services billed while the participant is in the hospital, a nursing home, or out of state

A sudden spike in hours or changes that aren’t supported by new assessments or approvals

If any of these issues appear, it can trigger closer review or a formal audit.

-

Families can reduce risk and stay compliant by:

Following the care plan closely and not adding tasks or hours that aren’t authorized

Keeping detailed records (timesheets, appointment logs, notes, text confirmations) that match what was billed

Using the approved payroll or EVV system correctly and on time

Not backdating or pre-signing timesheets, even “just this once”

Promptly reporting changes (hospital stays, moving, changes in condition, caregiver changes) to the case manager or fiscal intermediary

Asking questions in writing when they’re unsure, so they have proof they sought guidance

Good documentation is often the difference between a simple clarification and a fraud investigation.

-

If a family is unsure whether something is allowed, they should:

Contact their Medicaid case manager or support coordinator

Reach out to the fiscal intermediary / financial management service (FMS) handling payroll

Review written program handbooks and state self-directed care policies

For complex situations or potential overpayments, consider speaking with a qualified attorney or benefits advocate who understands Medicaid and self-directed programs

Asking for clarification before submitting timesheets or making changes is always safer than trying to fix a problem after an audit starts.