Louisiana Medicaid Income Limits: How to Qualify and Get Paid as a Family Caregiver

Louisiana Medicaid income limits determine who is eligible for state-funded health coverage and for many Home and Community Based Services (HCBS) programs that can pay family caregivers. This guide explains how income and resource rules interact with caregiver payment pathways, why household composition and the Federal Poverty Level (FPL) matter, and what practical steps families can take to check eligibility and enroll. Many families face confusing paperwork and shifting program rules when they try to get paid to care for an elderly or disabled relative; understanding which programs use FPL percentages, how assets are counted, and where consumer-directed options exist reduces delays and increases chances of qualification. The article maps current income- and asset-related criteria used in Louisiana Medicaid, clarifies which programs allow paid family caregivers, walks through the application and enrollment process, explains spend down mechanics and asset-protection considerations, and outlines how Paid.care can support applicants with coaching, training, enrollment tools, and payroll logistics. Throughout, readers will find practical checklists, comparison tables, and stepwise guidance to move from assessment to paid caregiving.

What Are the Current Louisiana Medicaid Income Limits for 2025?

Louisiana Medicaid income limits for 2025 are predominantly expressed as percentages of the Federal Poverty Level (FPL), which state programs use to determine eligibility; this approach ties eligibility to household size and updates annually with federal guidance. Using FPL percentages lets programs scale eligibility by household composition and apply different thresholds for expansion adults, pregnant people, and long-term services and supports. Because programs differ—some use a single percentage like 138% FPL while others apply program-specific rules—readers should treat the FPL-based thresholds below as the determinative framework and confirm exact dollar equivalents with official state materials. The following table summarizes common program categories, how household size affects thresholds, and the typical FPL percentages associated with each program type to help readers quickly identify which pathway is relevant to their situation. Understanding these program groupings enables an initial screening and guides the documentation collectors need for formal application.

How Does Household Size Affect Louisiana Medicaid Income Limits?

Household size directly scales FPL-based income limits because the Federal Poverty Level increases with each additional household member, which raises the monthly or annual income threshold proportionally for Medicaid programs that use FPL. To count household members for Medicaid eligibility you generally include the care recipient’s tax or household unit as defined by Medicaid rules, which can differ from IRS definitions; accurate counting affects whether a household falls above or below a given FPL percentage. For example, adding one adult or child increases the applicable FPL amount for the program threshold, which in turn increases the allowable income before eligibility is lost; conversely, undercounting members can erroneously suggest ineligibility. When preparing an application, gather documentation that shows household composition—such as birth certificates, marriage records, or proof of residency—because these documents directly influence the FPL calculation. Properly counting household members is the first practical step toward an accurate preliminary eligibility estimate and leads naturally to the next topic: which FPL percentages are applied by different programs.

What Are the Federal Poverty Level Percentages Used in Louisiana Medicaid?

The Federal Poverty Level (FPL) is a federal guideline updated yearly and expressed as an annual income amount for households of different sizes, and Louisiana Medicaid applies program-specific percentages of the FPL to set eligibility limits. Common thresholds that states, including Louisiana, use are 138% FPL for Medicaid expansion adults, higher percentages for children and pregnant people, and sometimes program-specific percentages or SSI-based methods for long-term care programs. Knowing which percentage a program uses is essential because it converts to a concrete monthly or annual dollar cutoff based on household size—understanding the percentage is the mechanism that clarifies whether a household qualifies. When checking eligibility, compute the household’s annual income and compare it to the FPL percentage used by the target program; this step reduces surprises during formal determination and prepares applicants for possible next steps such as spend down or documentation collection.

What Are the Medicaid Asset Limits in Louisiana for Caregiver Eligibility?

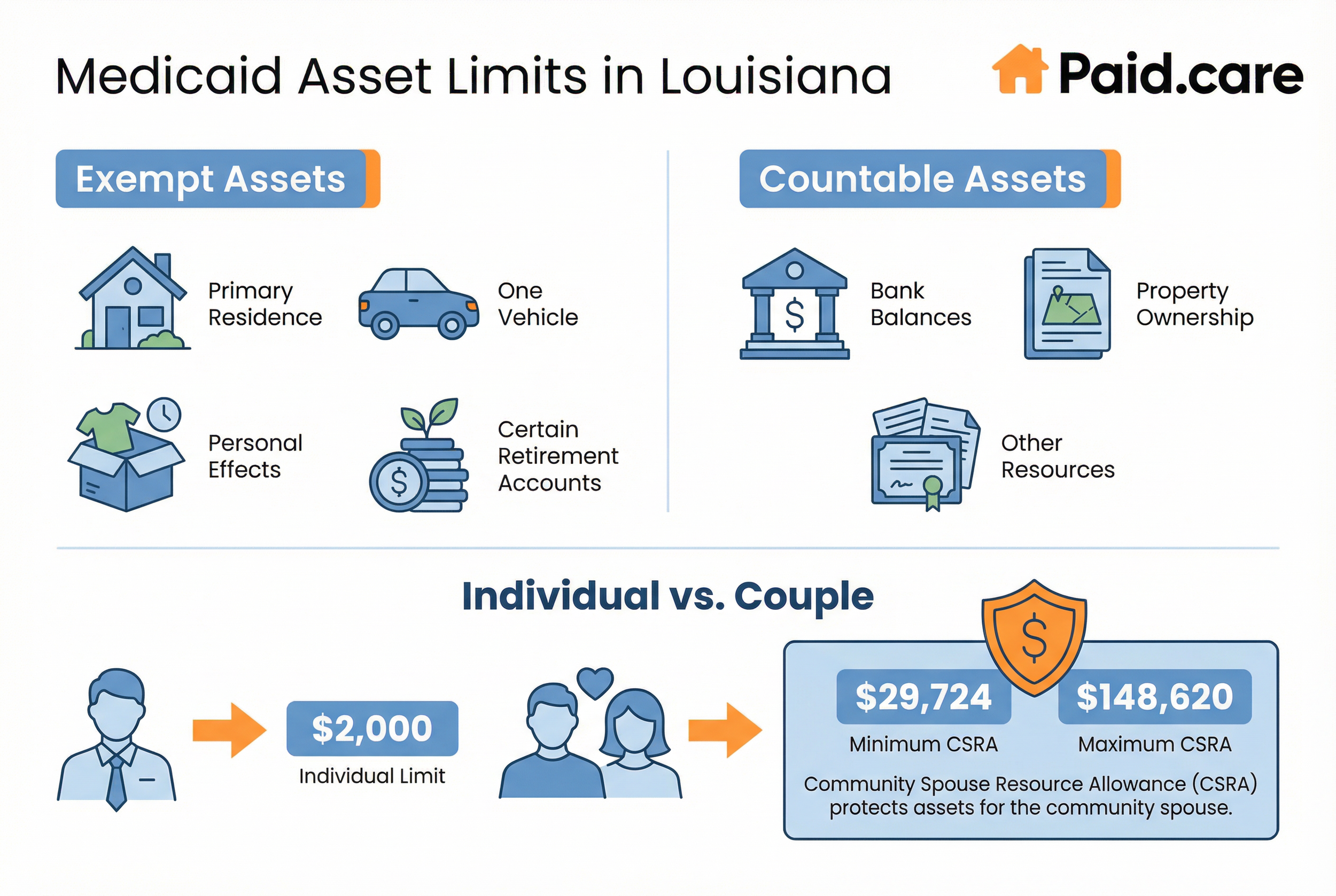

Medicaid asset limits determine whether a care recipient qualifies for long-term care coverage and for consumer-directed programs that fund paid family caregivers, with resource counting rules that differ from income calculations. Asset limits typically apply to long-term services and supports and are often lower than thresholds for other Medicaid categories; states distinguish countable resources from exempt assets and apply spousal protections when one spouse needs long-term services while the other remains in the community. Documentation is essential: proof of bank balances, property ownership, retirement accounts, and other resources is required during application.

Which Assets Are Exempt from Louisiana Medicaid Asset Limits?

Certain assets are routinely exempt from Medicaid resource limits to prevent impoverishment and allow families to access care without losing basic household necessities, and common exemptions include the primary residence (subject to equity limits or intent-to-return rules), one vehicle, personal effects, and certain retirement accounts. Exemptions may also apply to assets that are not readily available for use, such as some types of life insurance with nominal cash value, and to income-protected spousal resources under spousal-impoverishment rules. Documenting exemptions requires clear records—property deeds, vehicle titles, and retirement statements—to show ownership and valuation at the time of application. Understanding which assets are exempt reduces unnecessary asset transfers and helps families pursue lawful planning alternatives when countable resources exceed program thresholds. Knowing the exemptions prepares applicants for the next comparison of how rules differ for individuals versus couples.

How Do Asset Limits Differ for Individuals and Couples in Louisiana?

Asset limits for Medicaid vary when a married couple is involved because spousal impoverishment protections allocate a community spouse resource allowance that preserves a portion of assets for the spouse living in the community. For couples, eligibility calculations typically consider both spouses’ combined resources, then apply rules to set a minimum allocation for the community spouse before determining the institutionalized spouse’s countable assets. This mechanism prevents forcing the healthy spouse into poverty and often raises the effective resource allowance compared with single applicants. Examples and worksheets that apply the community spouse resource allowance make it easier to estimate qualification; obtaining advice from a benefits specialist or an elder-law attorney is advisable when spousal calculations are complex. With spousal rules understood, families can better decide whether to pursue HCBS waivers or other consumer-directed programs that enable paid family caregiving.

Which Louisiana Medicaid Programs Allow Family Caregivers to Get Paid?

Several Louisiana Medicaid programs and waivers permit family members to be paid when the care recipient elects consumer direction and when program rules allow hiring relatives; these programs typically include HCBS waivers and consumer-directed personal assistance services under state Medicaid authority. Consumer-directed models let beneficiaries hire personal care attendants—including, in many cases, qualifying family members—subject to rules about who may be employed, training requirements, and payroll administration.

How Do Home and Community Based Services Waivers Support Paid Family Caregivers?

Home and Community Based Services (HCBS) waivers support paid family caregivers by funding services that keep individuals in their homes instead of institutions, and by authorizing consumer direction in which beneficiaries hire and supervise attendants, sometimes including family members. Waivers fund a care plan based on an assessed level of care and documented needs; once a plan is approved, the beneficiary or their representative can choose between agency-based services or consumer-directed options that enable hiring known caregivers. The waiver mechanism increases choice and control for recipients and makes payment to family caregivers possible where state waiver rules permit it. For families navigating waivers, selecting consumer direction changes enrollment logistics—shifting responsibilities like employer paperwork, payroll, and training—so understanding that trade-off is essential before moving to application steps and potential supports through organizations that assist with enrollment logistics.

Paid.care can help families interpret HCBS waiver rules and consumer-direction mechanics, offering free care coaching, eligibility checks via its app, and guidance on training and payroll so families can move from approval to paid caregiving more smoothly.

What Are Consumer-Directed Personal Assistance Programs in Louisiana?

Consumer-directed personal assistance programs let eligible beneficiaries hire, train, supervise, and pay personal care attendants according to an authorized care plan, and these programs typically include clear procedures for employer enrollment, worker verification, payroll, and recordkeeping. Rules often specify who may be employed (some relatives may be excluded depending on the program), required training or certification, timesheet submission standards, and how payments are disbursed to caregivers. Managing employer responsibilities—tax withholding, worker eligibility, and maintaining documentation—becomes part of the consumer-directed model, so beneficiaries and family employers must be prepared for administrative duties. Understanding these operational details helps families weigh agency-based services against consumer direction and prepares them for the enrollment and payroll steps described in the next section.

How Can You Qualify for Louisiana Medicaid as a Family Caregiver?

Qualifying for Medicaid as a family caregiver begins with establishing the care recipient’s financial and functional eligibility and then completing program-specific enrollment steps that enable caregiver payment under consumer-directed models. The process generally starts with a preliminary screening for income and assets, proceeds to a formal application for Medicaid and any relevant waivers, includes a level-of-care assessment, and culminates in completing employer-enrollment and payroll requirements if consumer direction is chosen. The checklist and stepwise procedures below guide families through the practical tasks and documentation needed to move from initial assessment to an authorized care plan that permits paid caregiving. Preparing accurate documentation and following the program steps carefully increases the chance of a timely approval and avoids common administrative setbacks.

What Is the Process for Checking Initial Eligibility Based on Income and Assets?

A practical eligibility check begins by collecting key financial documents, estimating countable income and assets using program rules, and comparing those figures to the FPL-based thresholds and resource limits that apply to the target program. Typical documents to gather include recent pay stubs, bank statements, retirement account summaries, property deeds, and proof of household composition; these allow you to calculate adjusted monthly income and to identify exempt assets versus countable resources. Use a step-by-step approach: add household income, subtract allowable deductions per program rules, then compare the result to the program’s FPL percentage or resource limit to see if qualification is likely. Early screening identifies red flags—such as recent asset transfers or high countable resources—that might require spend down planning or professional advice. With a clear eligibility estimate, you can move purposefully into the application process and caregiver enrollment steps.

Common documents make the initial screening precise and actionable:

Pay stubs and proof of income: Last 2–4 pay periods and annual statements where available.

Bank and investment statements: Recent statements showing balances and account ownership.

Property and vehicle titles: Deeds and registration to establish ownership and potential exemptions.

Accurate documentation speeds the formal determination and reduces requests for additional evidence from the state agency.

How Do You Apply for Medicaid and Enroll as a Paid Family Caregiver in Louisiana?

Applying involves a sequence of steps: submit a Medicaid application for the care recipient, complete any waiver application if HCBS services are needed, undergo the level-of-care assessment, receive an approved care plan authorizing services, and then follow the program’s employer-enrollment steps if consumer-directed care is chosen. Practical steps include filling out the state Medicaid application online or by paper, attaching required proof of income and assets, requesting a functional assessment for long-term care needs, and selecting consumer direction when available; after authorization, the beneficiary or representative must complete employer paperwork, worker enrollment, and payroll setup. Below is a numbered checklist that captures the typical flow to align expectations and support featured-snippet style guidance.

Complete Medicaid application for the care recipient with income, asset, and identity documentation.

Request a level-of-care assessment to determine HCBS or institutional qualification.

Apply for the appropriate HCBS waiver if long-term services at home are needed.

Authorize a consumer-directed care plan and choose the caregiver to be paid.

Complete employer/enrollment and payroll setup for the caregiver per program rules.

Following these steps in order helps families avoid missteps; if any stage is unclear or you need help with employer paperwork and payroll, support resources can streamline the enrollment process.

Paid.care offers optional support during application and caregiver enrollment phases, providing eligibility checks in its mobile app, free care coaching to explain forms, help preparing documentation, training and certification options for caregivers, and weekly payment facilitation once a caregiver is approved.

What Is Medicaid Spend Down and How Does It Affect Louisiana Medicaid Eligibility?

Medicaid spend down is a mechanism that allows applicants with income or medical expenses above program limits to qualify by subtracting allowable medical costs or by meeting a monthly “spend down” obligation that reduces counted income to the eligibility threshold. Spend down converts excess income into qualifying expenses when those medical costs are documented and meet program rules, and it is commonly used for applicants whose income is slightly over an FPL-based limit but who have high medical spending. Understanding how to document expenses correctly, the timing of expense submissions, and whether the state uses a monthly or retroactive spend-down period is essential to avoid lost coverage or payment gaps. The following explanation and example clarify how spend down works and which documentation is persuasive during review.

How Does Medicaid Spend Down Work in Louisiana?

Spend down typically requires documenting allowable medical expenses—such as out-of-pocket costs, medical bills, and sometimes insurance premiums—so the state can offset those expenses against income to reach eligibility levels; the calculation may be monthly or quarterly depending on program rules. Practically, you total the household’s income for the applicable period, subtract the program’s income limit to find the excess, and then document medical expenses at or above that excess amount to meet the spend down. A worked example shows the mechanics: if monthly income exceeds the qualifying threshold by a specific amount, documented medical bills matching that excess satisfy the spend down for that month. Accurate receipts, billing statements, and proof of payment are critical to successful spend down claims and lead into asset protection strategies families may consider if spend down is not feasible.

What Asset Protection Strategies Can Help You Qualify for Medicaid?

Asset protection strategies focus on lawful planning options to meet Medicaid resource limits—such as maximizing exempt assets, arranging for permissible transfers in accordance with look-back rules, or restructuring holdings under professional guidance—but families should seek qualified elder-law or financial-planning advice before taking action. Common approaches include ensuring the primary residence qualifies for exemption where eligible, documenting legitimate medical debts as spend-down items, and reviewing retirement account treatment under Medicaid rules; however, avoid transfers that violate look-back or penalty-period rules. Because state-specific regulations and timelines vary, professional counsel helps craft strategies that respect legal constraints and preserve program eligibility. Sound planning complements the earlier steps of documenting income and medical expenses and prepares families for enrollment under consumer-directed programs.

Practical asset-protection tips include:

Organize documentation for all potential exemptions and gather titles, account statements, and bills.

Consult a qualified specialist before making transfers or complex financial moves.

Use permitted deductions such as recurring medical expenses to reduce countable income.

These steps reduce the risk of delays or denial and position families for a smoother Medicaid approval process.

Why Choose Paid.care for Navigating Louisiana Medicaid Income Limits and Caregiver Payment?

Paid.care is a lead generation and information hub that assists family caregivers in understanding and navigating state Medicaid programs and government pathways that enable paid caregiving. The company offers Free Care Coaching to help families interpret eligibility rules, 24/7 support for questions during the application process, and a mobile app that performs eligibility checks and tracks caregiving hours. Paid.care also provides training and certification options to prepare caregivers for employment under consumer-directed programs, dedicated care coaching to guide enrollment, and weekly payments to help caregivers receive timely compensation once approved. For families seeking a practical partner to move from eligibility assessment to payment, Paid.care combines information resources, coaching, and operational tools that reduce administrative burden and speed time to payroll.

How Does Paid.care Support Louisiana Family Caregivers with Training and Certification?

Paid.care supports caregivers by offering training modules and certification pathways designed to meet the knowledge and documentation expectations of consumer-directed programs, along with care coaches who explain required competencies and compliance steps. Training covers essential caregiving tasks, timesheet best practices, and documentation procedures that align with employer-enrollment requirements for consumer-directed payroll. Certification and structured training reduce administrative friction during enrollment and provide confidence that the caregiver meets program standards, which can be critical when agencies or state reviewers assess competency. This training prepares caregivers to perform their roles effectively and to maintain records that sustain ongoing payment and compliance.

What Resources and Tools Does Paid.care Offer for Louisiana Medicaid Applicants?

Paid.care provides a set of tools and resources designed to support families through eligibility checks, application assistance, and payroll logistics, including a mobile app for eligibility screening and hour tracking, free care coaching, and a state-by-state resource hub to explain program options. The app helps estimate whether a household’s income and assets likely meet program thresholds and simplifies timesheet tracking once caregiving begins, while coaching helps translate complex forms into actionable steps. Paid.care’s resource hub organizes information on consumer-directed programs and waiver options so families can compare pathways and choose the approach that fits their situation. These tools reduce administrative friction and help families move from approval to timely payment for caregiving services.

Eligibility checks: Quick screening tools to assess likely program fit.

Timesheet and hours tracking: Simplifies payroll readiness and documentation.

Free care coaching: Personalized guidance on enrollment steps and forms.

Training and certification: Prepares caregivers for employer requirements and service quality.

FAQs

-

The Limit: For 2025, the gross monthly income limit for an individual applicant is $2,901. This is based on the federal "300% Rule" (300% of the SSI Federal Benefit Rate).

The Detail: This limit applies only to the person needing care. If the applicant is married, the income of their spouse is generally disregarded for eligibility purposes, as long as the spouse is not also applying for Medicaid long-term care.

-

The Rule: Yes. Under the Community Choices Waiver (CCW), Louisiana offers a service called Monitored In-Home Caregiving (MIHC). This program explicitly allows family members, including spouses, to be paid as the primary caregiver.

The Requirement: To qualify, the spouse (or other family member) must live in the same home as the care recipient. You must be hired through a managed care organization (MCO) or a contracted provider agency that administers the MIHC program.

-

The Fix: Louisiana offers a "Waiver Spend-Down" option. If the applicant's income exceeds the limit, they can still qualify by "spending down" the excess income on medical expenses.

How It Works: The state calculates the "excess" income (income over the limit minus a small personal needs allowance). The applicant must pay this excess amount toward their medical care (or to the waiver provider) each month. Once that liability is met, Medicaid covers the remaining costs for that month.

-

The Rates: Payments are structured as a daily tax-free stipend rather than an hourly wage. The state pays a provider agency a daily rate based on the "tier" or difficulty of care (Level 1, 2, or 3).

Your Take-Home: The agency retains a portion for case management and administrative fees, passing the rest to you. While exact amounts vary by agency, caregivers typically receive between $85 and $150 per day depending on the complexity of the patient's medical needs.

-

The Limit: The applicant must have $2,000 or less in countable assets (cash, savings, stocks).

The Exemptions: The primary home is exempt (not counted) if the applicant lives there or has an "intent to return," and the equity value is below approximately $713,000. One vehicle is also exempt.

Spousal Protection: If the applicant is married, the "Community Spouse" (the one not applying for care) can keep significantly more assets—up to approximately $157,920 (2025 standard)—to prevent spousal impoverishment.