How Much Do Family Members Get Paid for Caregiving in Michigan? (2025 Guide)

If you are one of the thousands of Michiganders caring for an aging parent, a spouse, or a loved one with a disability, you know that caregiving is more than just a series of tasks. It is a labor of love, a full-time commitment, and, quite frankly, a job.

You spend hours managing medications, assisting with mobility, preparing meals, and providing the emotional support that keeps your loved one safe and happy at home. Yet, despite the immense value you provide, this work often goes unpaid. You might be cutting back hours at your "real" job or leaving the workforce entirely to manage care at home, creating a financial strain that adds stress to an already demanding situation.

Here is the news that many families in Michigan are relieved to hear: You can get paid for the care you are already providing.

Michigan has specific Medicaid programs designed to compensate family members for their time and effort. While the state’s direct rates can be modest, partnering with a professional agency like Paid.Care can significantly increase your earning potential—often up to $17 to $18 per hour—while removing the headache of government paperwork.

This guide will walk you through exactly how much you can earn, the programs available in 2024 and 2025, and how to maximize your pay while ensuring your loved one gets the best possible support.

The Reality of Caregiver Compensation in Michigan

The first question most families ask is, "What is the hourly rate?" The answer depends heavily on how you sign up.

In Michigan, caregiver pay is not a flat rate across the board. It fluctuates based on the specific Medicaid program your loved one qualifies for, the county you live in, and whether you work directly with the state or through a supportive home care agency.

The "State Rate" vs. The "Agency Rate"

If you sign up directly with the state as an individual provider, you are often locked into a base rate. As of late 2024 and moving into 2025, the Michigan Home Help Program generally pays individual caregivers a base rate that hovers around $13.53 to $16.25 per hour.

While this provides some financial relief, it often falls short of a living wage. Furthermore, working directly with the state means you are responsible for navigating the complex administrative burden alone.

The Agency Advantage: This is where Paid.Care changes the equation. When you work through an agency, you often unlock higher pay rates. At Paid.Care, we fight to get family caregivers the highest possible compensation.

Average Agency Pay: Typically starts at $17.00 to $18.00+ per hour.

Why is it higher? Agencies have different contracts and billing structures with the state. We pass those benefits on to you to ensure you are fairly compensated.

Over the course of a month, that difference adds up. An extra $2–$4 per hour can mean hundreds of dollars more in your pocket every month for doing the same loving work you are already doing.

The Primary Program: Michigan Home Help

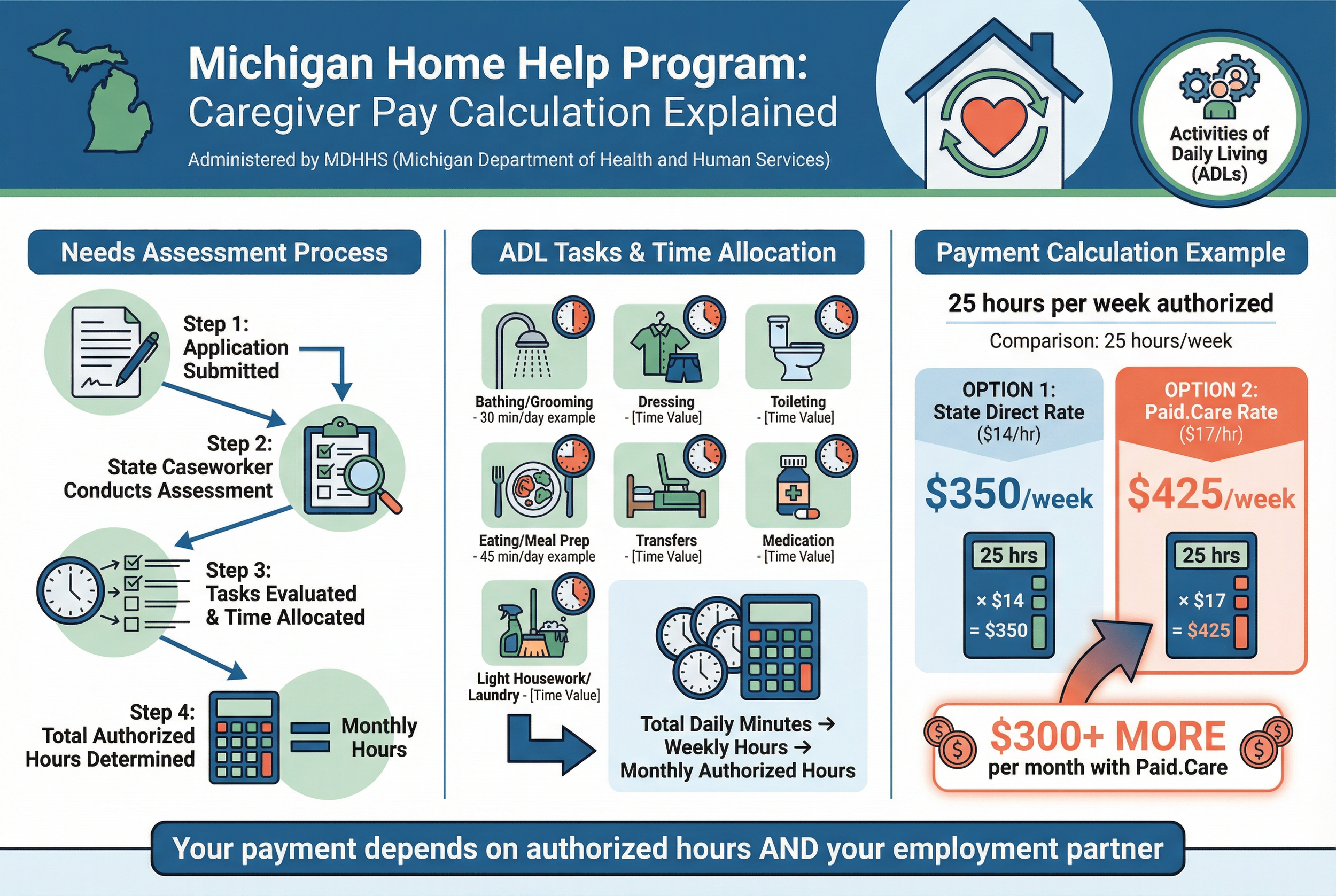

The most common route for family caregivers in Michigan is the Home Help Program. Administered by the Michigan Department of Health and Human Services (MDHHS), this program is designed specifically to support people who need assistance with "Activities of Daily Living" (ADLs) but want to stay in their own homes rather than move to a nursing facility.

How Pay Is Calculated

The amount you get paid isn't just about the hourly rate; it’s about the authorized hours.

When your loved one applies, a state caseworker will conduct an assessment (often called a "needs assessment"). They will look at specific tasks your loved one needs help with, such as:

Bathing and grooming

Dressing and undressing

Using the toilet

Eating and meal preparation

Moving from a bed to a chair (transfers)

Taking medication

Light housework and laundry

The caseworker assigns a time value to each task. For example, they might allocate 30 minutes a day for bathing and 45 minutes for meal prep. These minutes are added up to determine your total authorized hours per month.

Example Math: If your loved one is assessed to need 25 hours of care per week:

At the state direct rate ($14/hr): You earn roughly $350/week.

At the Paid.Care rate ($17/hr): You earn roughly $425/week.

That is a difference of over $300 per month, simply by choosing the right partner for your employment.

The MI Choice Waiver

For loved ones who require a higher level of care—specifically "Nursing Facility Level of Care"—Michigan offers the MI Choice Waiver. This program is distinct from Home Help and is intended for individuals who might otherwise need to live in a nursing home but choose to stay in their community.

Key Differences

Higher Care Needs: This program is for seniors or adults with disabilities who need significant, hands-on medical or supervisory care.

Agency Involvement: Unlike the Home Help program, where you can technically go it alone (though we don't recommend it), the MI Choice Waiver is almost exclusively administered through waiver agents and home care agencies.

Pay Structure: Pay rates for MI Choice can sometimes be higher due to the complexity of care, but they vary significantly by region and the specific waiver agency managing the case.

If your loved one needs constant supervision or has complex medical conditions, this waiver might grant more hours than the Home Help program, even if the hourly rate is similar.

New for 2025: Structured Family Caregiving

Michigan is in the process of rolling out and expanding a model known as Structured Family Caregiving (SFC). This is an exciting development for live-in family caregivers.

Unlike the hourly model of Home Help, Structured Family Caregiving typically pays a tax-free daily stipend.

How It Works

Live-In Requirement: You must live in the same home as the person you care for.

Daily Rate: Instead of clocking in and out for specific tasks, you receive a flat daily rate for the ongoing supervision and care you provide.

Coaching & Support: A key part of SFC is that you are assigned a professional coach. This isn't a boss, but a resource—someone to help you troubleshoot care challenges, offer advice on dementia behaviors, or just listen when you are burnt out.

While rates for this program are still being standardized across the state, in other states, SFC stipends often range from $80 to $120 per day, depending on the complexity of the patient's needs. Because this income is frequently tax-free (under specific IRS foster care exclusions), the "take-home" value can be significantly higher than a taxable hourly wage.

Who Is Eligible to Get Paid?

Understanding eligibility is the trickiest part of the process. Michigan is generous in many ways, but strict in others.

The Care Recipient (Your Loved One)

To hire a family member, the person receiving care must:

Be a Michigan Resident.

Be Medicaid Eligible: They must have active Medicaid coverage. If they have Medicare only, they do not qualify for these specific state payment programs (though dual-enrollment in both is fine).

Demonstrate Medical Necessity: A doctor must certify that they need help with activities of daily living. This is usually done via a specific medical needs form (DHS-54A).

The Caregiver (You)

Most family members and friends are eligible to be paid. This includes:

Adult children (caring for aging parents)

Grandchildren

Siblings

Nieces and nephews

Friends and neighbors

The "Responsible Relative" Rule (Spouses)

This is the most common "gotcha" in Michigan. Under the traditional Home Help Program, the state enforces a "Responsible Relative" rule. This rule generally states that spouses are legally responsible for each other's care and therefore cannot be paid to provide personal care services to their husband or wife. Similarly, parents cannot be paid to care for a minor child (under 18).

However, there are nuances:

MI Choice Waiver: Occasionally offers more flexibility or different definitions of family coverage.

Future Exceptions: As programs like Structured Family Caregiving expand, rules regarding spousal pay may evolve.

Workarounds: Sometimes, a different family member (like an adult child) can be the paid caregiver for one parent, while the spouse handles other unpaid duties.

If you are a spouse hoping to get paid, do not lose hope, but be aware that the path is narrower. We recommend speaking with a Paid.Care specialist who can look at your specific situation to see if any exceptions apply.

Why "Going It Alone" Is a Headache

You might be thinking, "Can't I just sign up with the state and keep all the money?"

Technically, yes. You can register as an Individual Provider. But before you do, you should understand what that actually entails. When you go direct, you are the employee and the administrator.

The Hidden Burdens of Direct State Enrollment

CHAMPS Registration: You must navigate the Community Health Automated Medicaid Processing System (CHAMPS). It is a notorious, complex government portal that is not user-friendly. One wrong box checked can delay your approval by months.

Tax Confusion: When paid directly by the state, you are often treated as an independent contractor or household employee. You have to figure out your own withholdings. Come tax season, many independent caregivers get hit with a surprise tax bill because nothing was set aside.

No Training: You are thrown into the deep end. If your loved one’s condition worsens, you have no professional nurse or care manager to call for advice.

Electronic Visit Verification (EVV): You must strictly log your location and hours using government-mandated apps. If the app glitches (which they do), you don't get paid until it's fixed.

The Paid.Care Solution: More Money, Less Stress

At Paid.Care, we believe you should be a daughter, a son, or a friend first—and a caregiver second. You shouldn't have to be an accountant or a bureaucrat.

When you join Paid.Care, we handle the "business" side of caregiving so you can focus on the "care" side.

1. Higher Pay Rates

We negotiate better rates. As mentioned, our caregivers typically earn between $17 and $18+ per hour. We maximize every authorized hour so you get the financial support you deserve.

2. We Handle the Paperwork

Forget CHAMPS. We assist with the enrollment process. We ensure your hours are submitted correctly and on time. We handle the payroll taxes so you aren't surprised by the IRS in April.

3. Professional Training & Credibility

We provide you with training resources. This isn't just about checking a box; it's about giving you the skills to care for your loved one safely. Knowing how to properly lift someone without hurting your back, or how to de-escalate a dementia moment, makes your day-to-day life infinitely easier.

4. Advocacy

If the state tries to cut your loved one’s hours during a reassessment, we are in your corner. We know the regulations and can help you advocate for the level of care that is medically necessary.

How to Get Started: A Simple Checklist

If you are ready to stop providing free care and start earning a paycheck, here is the path forward:

Step 1: Medicaid Check Ensure your loved one is enrolled in Medicaid. If they are on a "spend-down" or only have Medicare, they will need to apply for full Medicaid coverage first.

Step 2: Medical Certification You will need a specific form signed by a doctor (usually the DHS-54A) stating that your loved one needs help with hands-on care.

Step 3: Contact Paid.Care Before you get lost in the state website, contact us. We can pre-screen your eligibility. We will ask a few simple questions:

Does your loved one have Medicaid?

Do they need help with daily tasks like bathing or eating?

Are you willing to complete a background check?

Step 4: The Assessment We help coordinate the state assessment. A caseworker will visit (or call) to determine the number of hours you are eligible for.

Step 5: Start Getting Paid Once approved, you start logging your hours through our easy-to-use system, and you receive regular, reliable paychecks.

A Note on Taxes and Benefits

It is important to treat this income seriously. When you are paid through an agency like Paid.Care, you are a W-2 employee. This is a good thing.

Social Security Credits: You continue contributing to Social Security, which protects your own future retirement.

Unemployment Insurance: In certain cases, if your caregiving role ends, you may be eligible for unemployment benefits—something you rarely get as an independent contractor.

Tax Withholding: We withhold taxes from each paycheck, so you don't have to panic about saving 30% of your income for the end of the year.

Conclusion: You Deserve Support

Caregiving is noble work, but it shouldn't require you to sacrifice your own financial stability. The state of Michigan has set aside funds specifically for people like you—people who are keeping the healthcare system afloat by caring for loved ones at home.

You are already doing the work. You are already the expert on your loved one's needs. It is time you were recognized and compensated for it.

Don't leave money on the table or struggle through the application process alone.

FAQs

-

This is the most common question we receive. Under Michigan’s standard Home Help Program, the state enforces a "Responsible Relative" rule, which generally prevents spouses from being paid to care for each other. However, this rule does not apply to other family members—adult children, siblings, nieces, nephews, and grandchildren are all eligible to be paid.

Note: There are exceptions. If your loved one is enrolled in the MI Choice Waiver, rules regarding spousal pay can be more flexible. Additionally, Michigan’s 2025 budget includes funding for Structured Family Caregiving (SFC), a model that may allow spousal compensation. Because these programs are evolving, we recommend contacting a Paid.Care specialist to check your specific eligibility.

-

Generally, no. The wages paid to you are considered your income, not the income of the person receiving care. Therefore, your paycheck should not disqualify your loved one from Medicaid or reduce their Social Security benefits. However, if you live in the same household and apply for household-based benefits (like SNAP/Food Stamps), your new income may be factored into the household total.

-

In most cases, yes—caregiver pay is considered employment income by the IRS. However, there is a significant tax break available for many family caregivers called the "Difficulty of Care" exclusion (IRS Notice 2014-7). If you live in the same home as the Medicaid recipient you care for, your income may be 100% tax-free for federal and state income tax purposes. This can effectively increase your take-home pay by 20–30%.

-

To qualify for the Home Help program, your loved one generally needs to be enrolled in Medicaid. For 2025, the financial limits have been updated:

Income: For a single person, the monthly income limit is typically around $1,305 (effective April 2025). If their income is higher, they may still qualify through a "spend-down" (deductible) process.

Assets: Michigan has significantly increased the asset limit for many Medicaid categories. As of 2025, the asset limit for a single individual is $9,660 (up from the traditional $2,000 limit), and $14,470 for a married couple. Note that one primary vehicle and the home you live in are usually exempt from this calculation.

-

The timeline varies by county, but typically, the process takes between 30 to 60 days. This includes the time needed for the state to process the Medicaid application (if not already active), schedule the nurse/social worker assessment, and authorize the hours. At Paid.Care, we stay on top of the state caseworkers to ensure your application moves as fast as possible.