IHSS for Parents of Children With Disabilities: Pay Rules, Eligibility, and Hours Explained

Parents who provide daily care to a child with disabilities can sometimes be paid through Medicaid programs such as IHSS or state Home and Community-Based Services (HCBS) waivers, creating a pathway to both financial support and formalized care documentation. This article explains who qualifies, how pay and authorized hours are determined, and the step-by-step application and provider-enrollment process so parents can evaluate options for paid caregiving. Many families need clarity about functional-need assessments, documentation, and state variations; this guide breaks down eligibility rules, typical pay calculations, and the administrative tasks parents should expect. You will also find state-focused examples for Indiana, Michigan, and Illinois, downloadable-style checklists for applications, and practical tools to track hours and stay compliant. Throughout, related concepts such as consumer-directed care, respite funding, and time-tracking are integrated so parents can compare IHSS to other Medicaid waiver routes. If you want help checking eligibility or estimating pay, Paid.care can assist families with eligibility checks, pay estimation, training, and tracking; later sections explain how that support fits into each step.

Who Qualifies for IHSS as a Parent Provider for Children With Disabilities?

Who qualifies as a parent provider starts with the child’s Medicaid eligibility and a documented functional need; eligibility mechanisms connect the child’s assessed care needs to an allowable provider payment under state Medicaid or HCBS rules. A defining mechanism is the functional assessment: evaluators document ADL or medical-task deficits that justify authorized caregiver hours. Getting approved generally results in two benefits: formal authorization of paid hours and the documentation parents need for consistent care planning. The next paragraphs break eligibility into program-level requirements and illustrative qualifying care needs so parents understand whether to pursue IHSS or a waiver.

What Are the Medicaid and HCBS Eligibility Requirements for Parent Caregivers?

Medicaid and HCBS eligibility for parent-provider payment commonly requires three linked conditions: the child is enrolled in Medicaid, the child demonstrates functional limitations or medical needs that require regular assistance, and state program rules permit payment to family caregivers under consumer-directed models. Assessments typically measure ADLs (feeding, bathing, dressing), IADLs (meal prep, medication management), and skilled nursing tasks; the assessment outcome determines authorized hours. Legal relationship or guardianship is often required or documented, and some states impose program-specific restrictions on who may be paid. Understanding these baseline criteria helps parents prepare documentation and anticipate assessment questions when they contact their local Medicaid or county agency.

Which Disabilities and Care Needs Qualify Children for IHSS Parent Provider Programs?

Typical qualifying conditions include complex medical needs, significant developmental disabilities, and chronic conditions that impair independent function, each assessed case-by-case through functional and medical criteria. Tasks that commonly support approval include feeding assistance, tube-feeding, mobility support, medication administration, wound care, and supervision during seizures or behavioral crises; these are meronymic components of the overall care package used to justify hours. Illustrative cases show how combinations of ADL dependence plus medical tasks often lead to higher authorized hours than ADL needs alone. Because states evaluate eligibility differently, parents should document frequency, duration, and medical rationale for each task before assessment to improve authorization outcomes.

How Do Parents Apply for IHSS to Get Paid for Caring for Disabled Children?

Applying to be paid as a parent provider follows a predictable sequence: initial contact to start the Medicaid or waiver application, a needs assessment or home visit to authorize hours, and provider enrollment steps that convert authorization into payroll. The mechanism is administrative: the needs assessment creates an approved hours plan, and provider enrollment creates a legal and payroll pathway for the parent. Clear benefits of following the standard steps are predictable authorization timelines and a transparent appeals process if hours or payment are denied. The following H3 subsections map the exact steps parents should take and the common documents assessors request.

What Are the Step-by-Step IHSS Application Procedures for Parent Providers?

First, contact your state Medicaid agency or county IHSS office to request an intake or screening; intake typically schedules a functional assessment within 1–4 weeks depending on local capacity.

Second, complete Medicaid enrollment for the child if not already done, submitting required identification and medical evidence; this step is fundamental because program payments require recipient Medicaid eligibility.

Third, prepare for the assessment/home visit where an assessor documents ADLs/IADLs and recommends authorized hours; maintain a concise log of daily care tasks to present.

Fourth, after authorization, enroll as a paid provider by completing provider paperwork, identity verification, and any background checks or training the state requires; payroll setup follows provider approval.

Fifth, if authorization is denied or hours seem insufficient, use the documented assessment and medical records to file an appeal within the state-specified timeframe.

Paid.care can support parents at each step by checking eligibility, preparing required documents, and helping with provider enrollment and time-tracking setup. Educate family caregivers on eligibility and process for getting paid, and guide them to apply for Paid.care’s services. Paid.care’s support reduces administrative burden by organizing records, explaining assessment language, and setting up app-based hour tracking to match state timesheet requirements. The next subsection lists the typical documents and assessments to have ready before intake to streamline approval.

Which Documents and Assessments Are Required for IHSS Parent Provider Approval?

Assessors generally request a core set of documents to substantiate the child’s needs and the caregiver relationship; these items create the evidentiary basis for authorized hours and provider payment. Typical documentation includes proof of the parent–child relationship or guardianship, recent medical records and physician statements describing functional limitations, therapy notes showing ongoing needs, and a personal care log that records frequency and duration of daily tasks. Functional assessments performed by a nurse or social worker convert these documents into an authorized care plan with hours tied to specific tasks; documenting frequency (e.g., daily, weekly) and duration (minutes/hours) for each task helps calibrate authorized hours. Preparing these materials ahead of the assessment minimizes delays and supplies the assessor with the evidence used to determine payment eligibility.

What Are the IHSS Pay Rates and Maximum Hours Allowed for Parents Caring for Disabled Children?

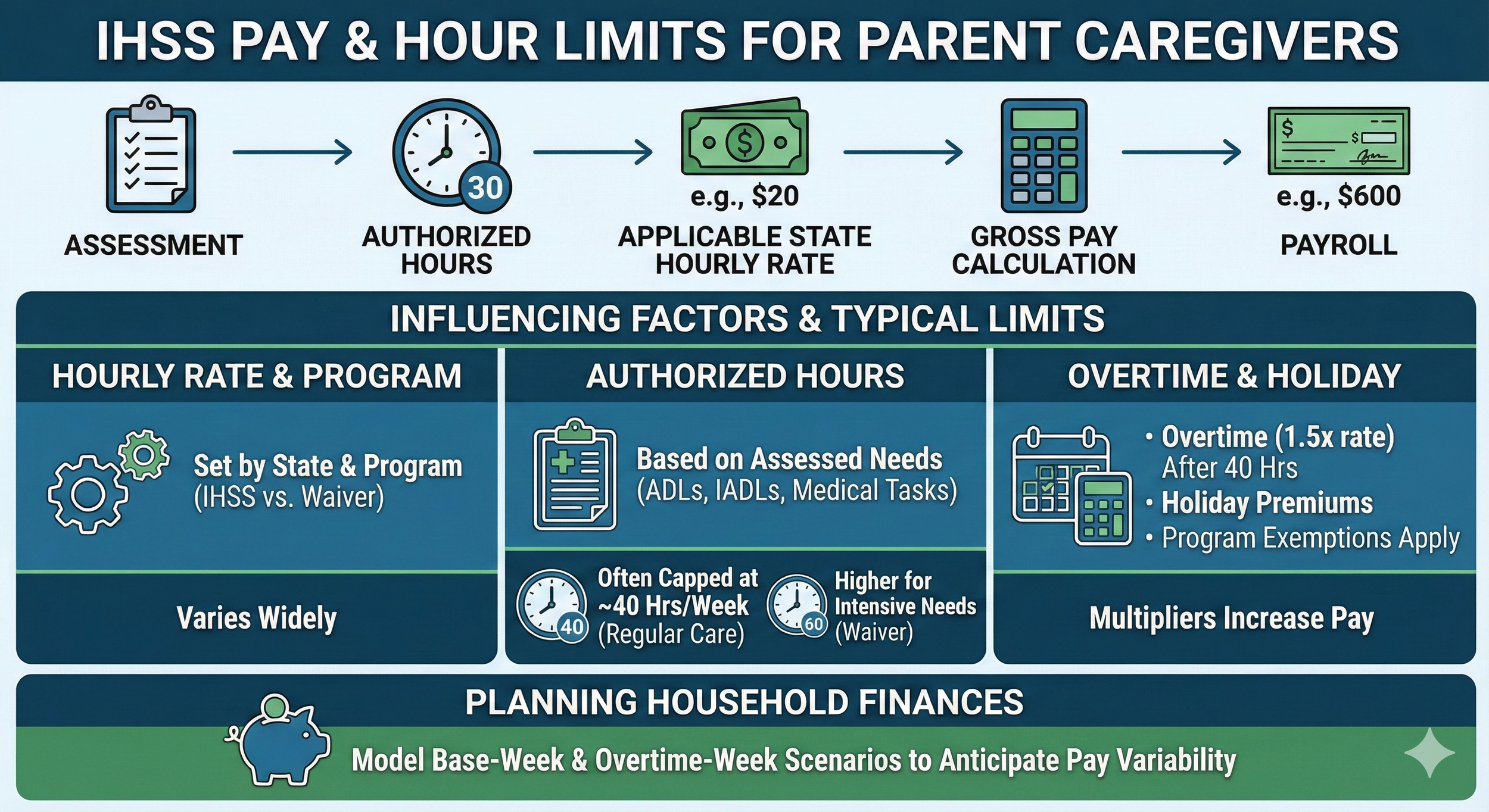

Pay rates and authorized hours are set at the state or program level, so the mechanism tying an assessment to payment is: assessment → authorized hours → applicable state hourly rate → payroll. The primary benefit for parents who are approved is predictable compensation that reflects authorized hours and state pay schedules, but the exact dollar amounts and caps vary widely by state. Below we summarize how pay is typically calculated, list the payment factors that commonly influence totals, and provide state-specific example scenarios for Indiana, Michigan, and Illinois as illustrative calculations rather than official rates.

Pay calculation follows a simple formula: hourly rate × authorized hours = gross pay for the pay period; from there, payroll rules determine overtime, tax withholding, and employer responsibilities if the state treats the recipient as employer. Factors that influence pay include the program type (IHSS vs. waiver), the state-set hourly rate, whether overtime or holiday premiums apply, and any caps on weekly authorized hours. To help parents see examples quickly, the table below shows illustrative state examples and notes about overtime and caps—these are example values to guide planning, not guaranteed state rates.

How Is IHSS Pay Calculated for Parent Caregivers and What Are Typical Hour Limits?

A basic example illustrates the calculation: if a state authorizes 30 hours per week at an hourly rate of $20, weekly gross pay is 30 × $20 = $600. Needs assessments influence that authorization by documenting how many hours are medically and functionally required for ADLs, IADLs, and medical tasks, and assessors often round to the nearest authorized hour block. Typical caps in many programs align around 40 hours per week for non-respite regular care, though higher hours can be authorized for intensive medical needs within certain waivers. Because holiday and overtime rules can change net pay, parents should model both base-week and overtime-week scenarios when planning household finances. The next subsection explains overtime and holiday rules in more detail to help parents anticipate pay variability.

Are There Overtime, Holiday, or State-Specific Pay Rules for IHSS Parent Providers?

Overtime, holiday pay, and special-state rules modify base pay by applying multipliers, different thresholds, or explicit exclusions; these policy mechanisms exist because payroll interacts with labor rules and Medicaid program design. Common patterns include overtime after 40 hours at 1.5× hourly rate, holiday differentials for designated state holidays, and program-specific exemptions where certain waiver payments do not follow standard overtime rules. Because states and program types (IHSS vs. waiver) may treat parent providers differently, parents should confirm whether provider enrollment treats the caregiver as an employee of the recipient or a contractor, since employer responsibilities and payroll taxes vary. Paid.care can help estimate pay under these scenarios and set up accurate time-tracking to ensure overtime is captured and paid correctly. Educate family caregivers on eligibility and process for getting paid, and guide them to apply for Paid.care’s services.

What IHSS and Equivalent Medicaid Waiver Programs Exist for Parents in Indiana, Michigan, and Illinois?

States vary in how they name and structure IHSS-like programs, but each state provides consumer-directed options or HCBS waivers that permit parents to be paid when rules and assessments allow. The mechanism is program design: some states use county-administered IHSS models, others use waiver slot systems with separate eligibility gates and waiting lists. Understanding program labels and where waivers sit in each state’s Medicaid structure helps parents identify the correct office to contact and the right forms to submit. The next subsections describe Indiana specifics and then a combined summary of Michigan and Illinois programs so families can compare program mechanics across states.

How Do Indiana Medicaid Waiver and Paid.care Support Parent Caregivers?

Indiana’s Medicaid waivers and consumer-directed options are notable in public reporting for relatively higher daily pay examples in some cases, with commentary that parent-provider pay can approach or exceed $250 per day in specific situations; these observations reflect the interaction of higher hourly rates and authorized hours. Families in Indiana preparing to apply should gather medical evidence, daily care logs, and assessment-friendly documentation to support higher-hour authorizations when medical complexity justifies them. Paid.care supports Indiana families by checking eligibility under state-specific Medicaid waivers, estimating likely pay using its pay calculator, preparing documentation for assessments, and offering time-tracking tools to match state timesheet requirements. This combination of eligibility verification and practical tools helps parents convert authorized hours into reliable pay with fewer administrative errors.

What Are Michigan’s HCBS and Illinois Home Care Programs for Parent Providers?

Michigan and Illinois both operate HCBS waivers and consumer-directed services that permit parent payment under qualifying circumstances, but program features—such as rate-setting, authorized-hour caps, and provider-enrollment requirements—differ by state and program stream. Michigan typically uses waiver slots and program streams that require clinical justification for higher-hour authorizations, while Illinois maintains home-care programs with consumer-directed elements that can allow family caregiver payment once assessments and provider enrollment are completed. Families moving across state lines or comparing programs should inventory program names, contact points, and typical timelines because transfer or re-application often requires re-assessment. Paid.care can help families with cross-state questions by clarifying local program names and assisting with eligibility checks in multiple states.

What Additional Support and Resources Are Available Beyond IHSS Pay for Parent Caregivers?

Beyond direct pay, parents can access a range of supports that reduce caregiver burden and improve care quality, including caregiver training, coaching, respite funding, and digital tools for documentation and payroll. These supports function as complements to IHSS: training increases skill and compliance, coaching helps navigate appeals and assessments, respite funding reduces burnout, and apps standardize time-tracking to ensure accurate payroll. Accessing these supports helps parents convert authorized hours into sustainable caregiving roles and builds a documentation trail that supports appeals or future re-assessments. The next subsections describe Paid.care’s offerings and financial/respite planning options available to families.

How Does Paid.care Provide Caregiver Training, Coaching, and App Tools?

Paid.care offers a set of services designed to help family caregivers manage the administrative, training, and documentation aspects of paid caregiving, including caregiver training, free coaching, an app for tracking hours and care tasks, and tools for estimating pay. The Paid.care App supports time tracking, care-task documentation, and basic care-management messaging so families can compile assessor-ready records and meet payroll reporting requirements. Free care coaching helps caregivers understand eligibility rules, prepare documents, and navigate enrollment steps, while Paid.care’s pay calculator provides quick estimate scenarios to model weekly pay under different authorized-hour assumptions. Educate family caregivers on eligibility and process for getting paid, and guide them to apply for Paid.care’s services. These services reduce administrative friction and strengthen the evidence package used in assessments and appeals.

Eligibility Checks: Verifies program fit and flags required documentation.

Document Prep: Organizes medical records and care logs for assessments.

Time Tracking & Payroll Tools: Sets up app-based tracking to match state timesheets.

These supports work together to streamline approval and payroll setup; the next subsection outlines community and financial resources parents can combine with paid caregiving income.

What Financial Planning and Respite Care Options Help Parents Caring for Disabled Children?

Families should consider several financial and respite strategies that pair with paid caregiving income to stabilize household finances and manage caregiver strain, including waiver-funded respite, local nonprofit grants, tax-advantaged planning, and emergency-care vouchers where available. Respite funding is often part of HCBS waivers or available through community providers, and it reduces burnout by providing scheduled relief for the parent caregiver. Financial planning items to consider include budgeting for payroll taxes if applicable, planning for periods when authorized hours fluctuate, and identifying public benefits or charitable supports that can supplement caregiver income. For tailored planning and referrals to respite programs or financial advisors, families can use coaching services that understand Medicaid interplay and documentation needs.

What Are the Most Common Questions About IHSS Pay Rules and Hours for Parents of Disabled Children?

This section addresses top questions parents ask about being paid as a caregiver, offering short, actionable answers so readers can take next steps with confidence. Each answer clarifies the typical mechanism, a practical caveat, and where to verify state-specific policy. After these FAQs, a brief call to action explains how to check eligibility and apply for assistance.

Can Parents Get Paid to Care for Their Disabled Child Through Medicaid or IHSS?

Yes — parents can sometimes be paid through Medicaid programs when the child is Medicaid-eligible and the state program permits family-provider payment; payment hinges on a documented functional need that justifies authorized hours. The practical next step is to confirm the child’s Medicaid eligibility, request an intake or screening with the state agency, and compile medical and daily-care documentation for the assessor. Because states and waivers differ in their rules and allowable provider types, verifying program-specific policies with the state Medicaid office is essential before assuming pay will be available. For families who want hands-on assistance, Paid.care can check eligibility and walk caregivers through the application and documentation process.

How Many Hours Can a Parent Work as an IHSS Provider and Still Receive Payment?

Authorized hours are determined by the functional assessment and program caps; many programs authorize up to around 40 hours per week for standard care needs, with higher limits possible for intensive medical or behavioral needs under specific waivers. The key mechanism is that assessors document the time required to safely meet ADLs/IADLs and medical tasks, and then authorize hours that reflect that documented need; weekly caps or program limits apply in some states. If a parent’s documented hours approach overtime thresholds, accurate time-tracking and clear documentation become critical to ensure appropriate overtime pay where applicable. To verify likely hour authorizations for your child, consider an eligibility and needs-review with a coaching service that understands state rules.

Educate family caregivers on eligibility and process for getting paid, and guide them to apply for Paid.care’s services. Paid.care assists with eligibility checks, document preparation, caregiver training, and app-based time tracking so families can move from inquiry to enrollment with fewer administrative delays. If you are ready to see whether your family qualifies and to estimate potential pay and hours, start by compiling your child’s most recent medical records, a week-long care log illustrating daily tasks, and proof of Medicaid enrollment for the child; then contact a program navigator or Paid.care to begin the eligibility check and application support process.

FAQs

-

In-Home Supportive Services (IHSS) is a Medicaid-funded program that pays caregivers to help a person with disabilities remain safely at home. When the recipient is a child, a parent can sometimes be approved as the paid IHSS provider if the child needs care beyond what a typical child of the same age would need and no other suitable caregiver is available.

-

Yes, in many cases. A parent may be approved as the child’s IHSS provider when:

The child has a qualifying disability and meets financial/Medicaid eligibility.

The child requires constant supervision or hands-on help with daily tasks (ADLs/IADLs).

No other appropriate caregiver is available, or the parent must be home instead of working because of the child’s care needs.

Final approval is made by the county/state agency after an assessment.

-

An assessor reviews medical records, talks with the parent, and evaluates what help the child needs with tasks like bathing, dressing, toileting, feeding, mobility, behavioral support, and protective supervision. They compare the child’s needs to what would be typical for a child of the same age and assign authorized IHSS hours based on the extra support required.

-

Sometimes, but not always. Many programs only approve one primary parent provider for most or all hours, though a second parent may be listed as an alternate or share hours in special situations (for example, split households or very high care needs). Rules vary by county and state, so parents should ask their local IHSS/Medicaid office how they handle two-parent households.

-

IHSS payments are usually treated as income to the caregiver, not the child, but they can still interact with SSI, CalFresh, or other programs depending on how the household’s income is counted. Because rules are complex and change over time, it’s important to:

Tell Social Security and any benefits agencies about IHSS income.

Ask how IHSS provider pay will be treated for your specific case.

Many families also work with an advocate or benefits counselor to make sure they keep as much support as possible.